This blog has been published by Huffington Post Australia

“I’ve Done The Math And Have Finally Worked Out When First-Home Buyers Had It Toughest”

Sydney First Home Buyer Housing Affordability – A Comparison Between 1989 and Today

I was at a presentation on Saturday where the issue of housing affordability came up. It started me thinking about how does buying your first home in Sydney today, compares to when my wife and I bought our first home in the western suburbs of Sydney nearly 30 years ago in 1989.

So I went through some of my old paperwork and did some research and this is what I found.

If you directly compare the circumstances around Sydney house prices and interest rates that existed in 1989 with those that exist in 2017, you could come to the conclusion that homes in Sydney today are more affordable for first home buyers than when my wife and I purchased our first home in 1989.

But what this does not take into consideration is what happened with interest rates in the period subsequent to 1989. When you take these substantial reductions in interest rates into effect, it becomes clear that purchasing a first home in Sydney today is less affordable than it was in 1989, a period you could previously argue was one of the least affordable times to buy such a home in Sydney.

Read on to see my analysis.

What was happening in the Sydney Property Market in 1989?

I want to look at the Sydney property market in the lead up to 1989 and today.

According to the Australian Bureau of Statistics 6416.0 Residential Property Price Indexes Sydney, between June 2012 and June 2017, house prices in Sydney have grown by 74%.

Data compiled by Successways (https://successfulways.com.au/graph-median-house-price-1970-2016/), shows that between:

- June 2012 and June 2016, median house prices in Sydney grew by 75%; and,

- June 1985 and June 1989, median house prices in Sydney grew by 127%.

Research published by Peter Abelson and Demi Chung, Housing Prices in Australia 1970 to 2003, shows that between June 1985 and June 1989, median house prices in Sydney grew by 93%.

So, it would be fair to say that the experience of first home buyers in 1989 and 2017 are similar. They have both experienced significant increases in house prices in the years immediately prior to them wanting to buy their first home. So the circumstances that first home buyers are facing in 2017 are not substantially different from what a first home buyer (like myself and my wife) faced in 1989.

The other factor impacting on property was interest rates. In June 1985 interest rates for home loans were around 12% according to finder.com.au. By August 1989 they had climbed to 17%.

Contrast this with now where the RBA cash rate is 1.5%, as compared to June 2012 when it was 3.5%.

So the first home buyer in 1989 had the double hit of significant house price and interest rate increases. The first home buyer of today has the hit of significant house price increases partially offset by the savings in interest costs.

Our First Home Purchase and what it would cost today

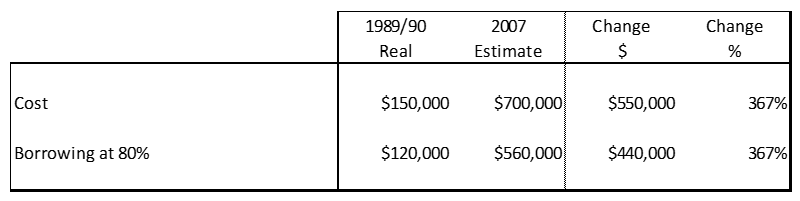

Back in 1989 we purchased our first home, a 2 bedroom weatherboard home in the western suburbs of Sydney for $150,000. At 80% borrowing the loan was $120,000.

Roll forward to today. Now I can’t directly compare our old house, as after we sold it, it was knocked down and a child care centre built instead. But looking at similar 2 bedroom homes in the area, it looks like they are selling today for around $700,000. At 80% borrowing the loan would be $560,000.

This is a 367% increase in the value of the house and required loan.

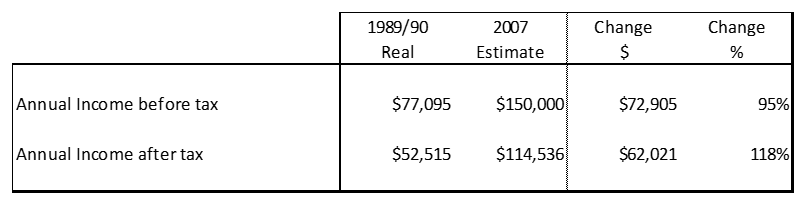

If we look at our incomes, from our 1990 tax returns (which I still have), our combined incomes before tax were $77,095. I was an audit manager and my wife was a bank teller. Our after tax income was $52,515.

Today, based on what I can see online, the 2017 annual incomes would be around $150,000 for these two same roles. This is an increase of only 95%. My estimate of an after tax income would be $114,536.

Note incomes after tax have gone up more than incomes before tax because there are lower income tax rates in 2017 / 2018 than there were in 1899 / 1990.

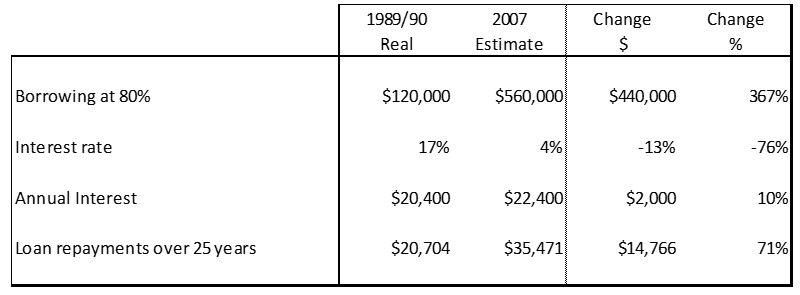

Now in 1989 we were paying 17% interest compared to today where you can get a home loan for under 4%.

Our First Home Loan

So at 17% interest rate on a $120,000 loan, we were paying $20,400 dollars per year in interest and our loan repayment over 25 years was $20,704.

At 4% interest rate on a $560,000 loan, first home buyers today would be paying $22,400 dollars per year in interest. The loan repayment over 25 years would be $35,471, obviously higher as they have more principal to repay.

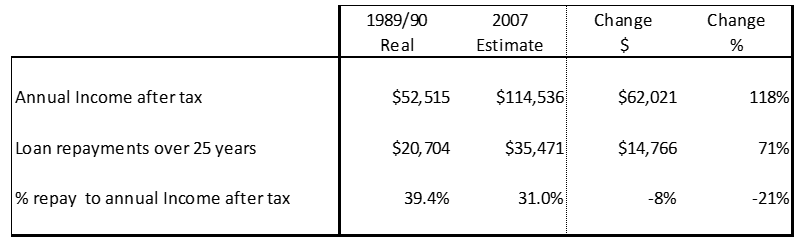

So if we compare the circumstances that existed in 1989 with those that exist in 2017, we would see that on a like for like basis, after tax incomes are up 118%, with loan repayments up 71%.

So in 1989, or loan repayments were over 39% of our after tax income. Roll forward to 2017 and the amount would be 31%.

The above table only looks at what would happen in the first year.

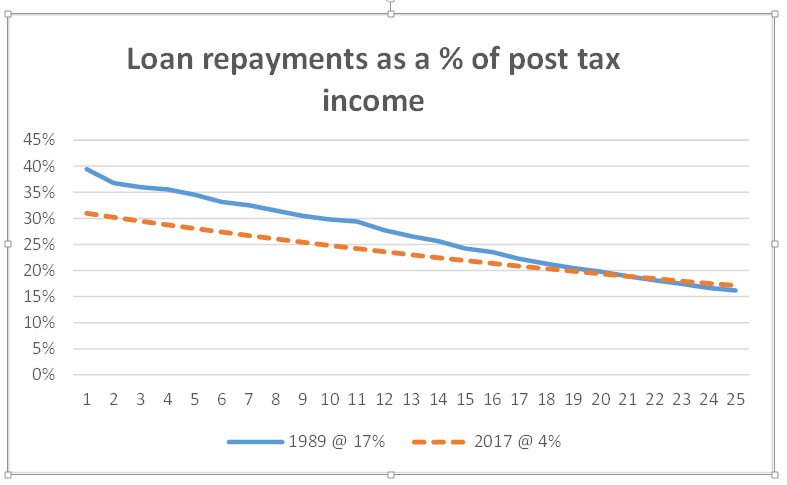

If we stay with the same interest rates and grow annual incomes from 1989 to today in line with the change in average weekly earnings and beyond at 2.5% per annum, here is how much of post tax income you would need to repay the 1989 loan and the 2017 loan.

As you can see, the 1989 loan (at 17% interest rate) would require more of the post tax income than the 2017 loan would.

Hence why, if we compare directly the circumstances that existed in 1989 with those that exist today in Sydney, you could say Sydney houses are more affordable for first home buyers today.

But what has happened since 1989?

As we all know, interest rates have decreased substantially from 1989 and you can get a loan today at 4% or less.

So, like my wife and I, anyone who purchased their first home in Sydney in 1989, and suffered a substantial financial drain to make loan repayments back then, has benefited from the interest rate drops thereafter.

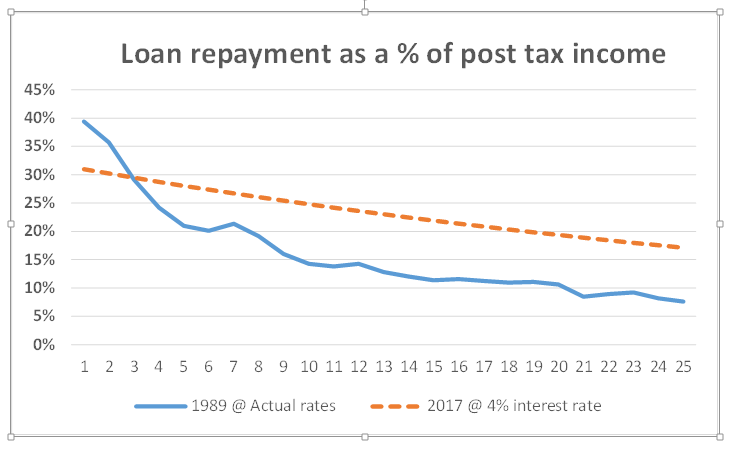

If we factor in some of these interest rate drops, you will see what really happened.

The 1989 first home buyer was spending more of their post tax income than the 2017 first home buyer for a couple of years. But as the interest rate reductions took effect, then very quickly, the 1989 first home buyer ends up paying less of their post tax income than the 2017 first home buyer.

So you would have to say that buying your first home in Sydney today is more unaffordable than in 1989 when we paid 17% interest rates and were heading for the recession we had to have.

Could the 2017 first home buyer benefit like the 1989 first home buyer?

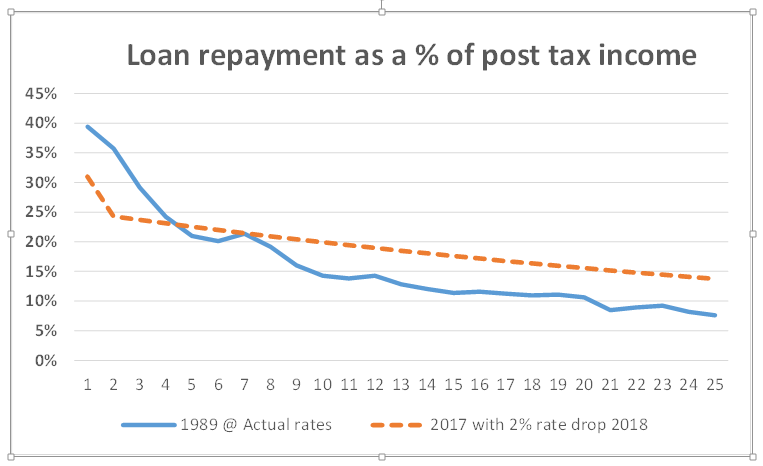

Given interest rates are already at a historical low, it seems hard to imagine that the 2017 first home buyer could benefit like the 1989 first home buyer from interest rate cuts.

Even If we assume rates do drop and these first home owners can get their loan down to 2%, as the chart below shows, they are still spending more of their post tax income than the 1989 borrower did on their lower interest rates.

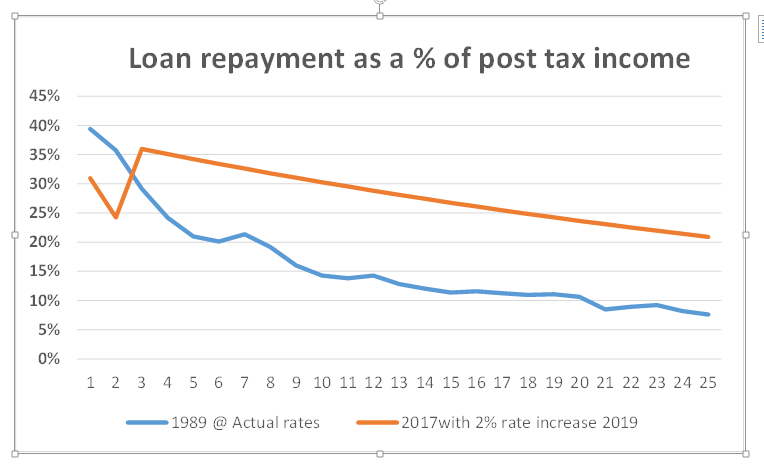

And the likelihood is that interest rates will go up and not down over the next 25 years, so the real result will actually be worse as the following chart demonstrates.

Conclusion

If you directly compare the circumstances around Sydney house prices and interest rates that existed in 1989 with those that exist in 2017, you could come to the conclusion that homes in Sydney today are more affordable for first home buyers than when my wife and I purchased our first home in 1989.

But what this does not take into consideration is what happened with interest rates in the period subsequent to 1989. When you take these substantial reductions in interest rates into effect, it becomes clear that purchasing a first home in Sydney today is less affordable than it was in 1989, a period you could previously argue was one of the least affordable times to buy such a home in Sydney.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Register for my FREE Seminars and Webinars

FREE seminars and webinars with tips and strategies you can action today to get off the treadmill of working till you drop – plus time for your questions

Do you and your family a favour and start taking steps so you improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below