What “Bedroom” Suburbs have to do with the Housing Affordability Issue

Mum and Dad investors who negatively gear investment properties, are being blamed for the Housing Affordability issue and why first home owners are not able to afford to purchase their first home.

But this is not true. The real reason why Australia is experiencing housing affordability issues in Sydney and Melbourne, is the rise of the “bedroom” suburb.

Let’s look at the Mum and Dad property investors

Negative gearing taxation laws apply consistently across Australia. Whether you have an investment property in Alawa in the Northern Territory or in Zeehan in Tasmania, or anywhere else in between, the taxation rules are the same.

So if the negative gearing tax rules are the same across Australia, and Mum and Dad negative geared property investors were the major cause behind the housing affordability issues, surely you would expect to see similar issues in all locations around Australia.

But that is not the case.

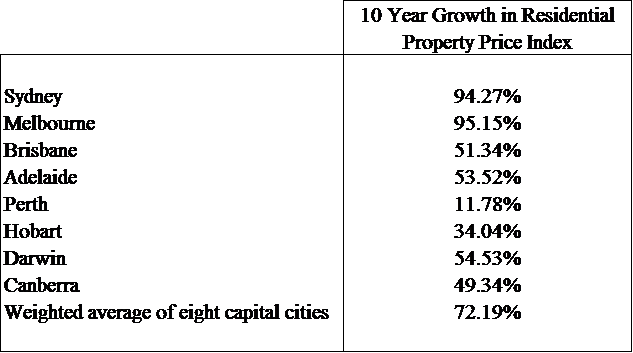

Over the past 10 years Sydney and Melbourne house prices have significantly outpaced the other capital cities. For example, using Australian Bureau of Statistics data from their Residential Property Price Indexes: Eight Capital Cities report you can see that Sydney and Melbourne house prices have grown nearly double what Brisbane, Adelaide, Darwin and Canberra did over the same time.

Source: ABS Report 6416.0 Residential Property Price Indexes: Eight Capital Cities Sept 2006 to Sept 2016.

If you compare the growth of Sydney house prices with regional NSW towns, you see the same trends. Suburbs in Sydney are seeing house price growth around double what regional towns in NSW are experiencing.

So if Mum and Dad investors who negatively gear investment properties, are causing the house price growth in Sydney and Melbourne, why are other capital cities and regional towns in Australia not experiencing the same problem?

Simple, because Mum and Dad investors who negatively gear investment properties, are not causing the housing affordability issues in Sydney and Melbourne!

So who / what is causing the Housing Affordability issues in Sydney and Melbourne?

So if Mum and Dad investors who negatively gear investment properties are not causing the Housing Affordability issue, who / what is?

In my view it is the unintended consequence of successive governments and businesses having a Sydney and Melbourne focus at the expense of our regional towns in particular.

And this Sydney and Melbourne focus drives people wanting to work (and live) in Sydney and Melbourne.

If you look at Sydney and Melbourne’s population you will see that:

- Sydney’s population between 2005 and 2015, grew by over 703,000 people (nearly 17 per cent) whilst Regional NSW grew by 221,000 people (just under 9 per cent).

- Melbourne’s population between 2005 and 2015, grew by over 832,000 people (22 per cent) whilst Regional Victoria only grew by 116,000 people (9 per cent).

- Sydney’s population is nearly 65 per cent of NSW’s population.

- Melbourne’s population is over 76 per cent of Victoria’s population.

Nearly 40 per cent of Australia’s population live in Sydney and Melbourne. Compare that with the United States of America, where its two largest cities, New York and Los Angeles have around 11 per cent of the total population of the United States.

And what is the consequence of this ever increasing influx of people into Sydney and Melbourne?

Simple – more demand for houses for people to live in.

So we have a government and business focus driving more demand for housing in Sydney and Melbourne.

What has happened with supply?

Yes supply has increased, but is it the supply people want?

We have new plenty of boxy one and two bedroom apartments being built and what I call bedroom suburbs.

Bedroom Suburbs

Bedroom suburbs are those estates where developers and the Government create these huge new developments on the outer edges of the city that house thousands of people, but have very few new jobs. Why do I call them bedroom suburbs? Simple, nearly everyone has to leave the suburb to commute to go to work.

Are these the type of housing people want?

I would suggest not.

How many families want to live in an apartment? In my experience very few families would want to live in a one or two bedroom apartment.

How many families really want to live way out of the city in a bedroom suburb and spend hour upon hour each week commuting? Especially if the public transport has not kept pace with the housing developments. In my experience, if they had a choice people would prefer to avoid commuting.

The real demand for housing in Sydney and Melbourne is housing in the inner and middle rings

Both of these means that the real demand for housing in Sydney and Melbourne is housing in the inner and middle rings.

And guess what, we have more demand, but there are not a many more homes in those areas than there was 20 years ago. In some areas, no more homes that there was 50 years ago.

So what happens, more demand, with little if any change in supply, means prices go up. And as one suburb goes up, the next suburb out follows not long thereafter.

Suddenly you have house prices rising across Sydney and Melbourne faster than wages are growing.

And it is all down to successive governments and businesses having a Sydney and Melbourne focus at the expense of our regional towns in particular.

The solution

So to fix the Housing Affordability issue in the long term, we need to stop building bedroom suburbs and future apartment ghettos. We need to start building satellite cities outside of Sydney and Melbourne with work and housing all in the same area.

Until we manage to entice more people to live outside of Sydney and Melbourne, and damper demand for housing in those two cities, you will never fix Sydney or Melbourne’s housing affordability issues.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Want to change your income by thousands of dollars?

Then get your FREE gift from The Wealth Navigator “The 5 P’s to Get Your Boss to Pay You More”

Want to change your income by thousands of dollars, then get my FREE guide

If you want to increase your income by thousands of dollars, you need to get my FREE guide and video, “The 5 P’s to Get Your Boss to Pay You More”.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below