Despite 25 years of Compulsory Superannuation in Australia, most people remain on the Treadmill to Work Till They Drop

The Retirement Readiness Report, by the American Academy of Actuaries, the Australian Actuaries Institute, and the Institute and Faculty of Actuaries in the United Kingdom issued this week, concludes that inertia and procrastination are driving a lack of preparation for retirement.

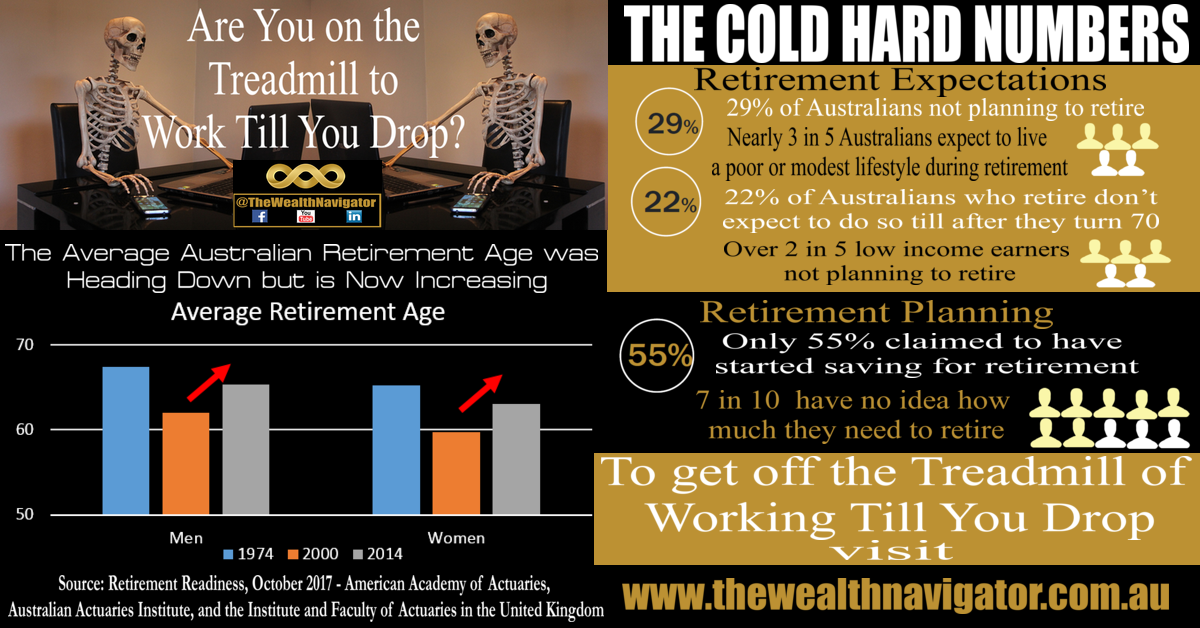

I believe that the overall effectiveness of the superannuation system in Australia needs to be reconsidered in the light of the Retirement Readiness Report’s Australian findings, summarised in the infographic, which include:

- the average age of retirement is increasing;

- many people are planning not to retire at all;

- most are planning to retire gradually rather than fully;

- many are planning to retire after they turn 70; and,

- relatively few are expecting a comfortable lifestyle in Retirement.

This lack of engagement through inertia and procrastination, means that the compulsory superannuation system is failing in its efforts to get the majority of Australians off the pension.

So what needs to happen?

We need to change. “Doing the same thing and expecting a different result is the definition of insanity”.

And there are two key changes that the Government and the Superannuation Industry need to make, sooner, rather than later.

Right now, people get their annual super statement and it has a balance. But very few people actually understand what that really means for them in retirement. We need to convert that to a payment stream in retirement.

For example, if your balance is $50,000, at an earnings rate of 5%, this would translate over 15 years into a monthly payment to you of $395.

That $50,000 sounds a lot, but when you translate this onto just $395 a month, then people really understand how little that really is.

Now obviously the government should set the earnings rate and period of drawdown, so that everyone is comparing apples with apples. Maybe women have a longer period of drawdown as they generally live longer.

And the other change is that all Australian’s need better education around financial literacy, especially around how financial decisions today impact on future retirement outcomes.

Apart from making people aware that the Australian superannuation system means that the responsibility for their retirement rests with them, this financial literacy education should focus on helping people:

- spend less than they earn;

- increase their income; and,

- invest the difference and make money work for them.

People who do so are more likely to retire when they wanted, and get off the treadmill of working till they drop.

Parts of this post have been reported in Money Management. Click here to see the Money Management Article or on the Money Management logo below

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Register for my FREE Why Work Till You Drop Webinar

FREE online webinar with tips and strategies you can action today to get off the treadmill of working till you drop – plus time for your questions

Do you and your family a favour and start taking steps to improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below