Are banks doing you a favour with 30 year loan terms?

For a long time, 25 years was the standard length (or term) for a loan to buy a house.

Today we are seeing more and more people sign up for 30 year loan terms.

So are 30 year loan terms better or worse for you?

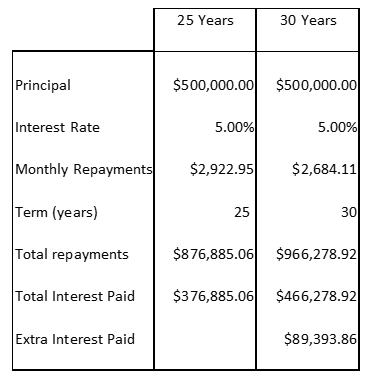

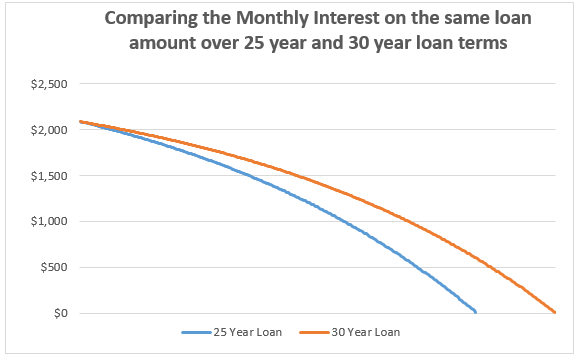

Let’s compare a $500,000 loan at 5% interest rate over 25 and 30 years that Carey and Weeam are looking at.

If Carey and Weeam take the 30 year loan term, they will have lower monthly repayments ($2,684.11 v’s $2,922.95) as the principal is repaid over a longer term.

But they will have to pay an extra $89,393.86 in interest.

So, if you are making your choice on interest alone, you would choose the 25 year option every time.

So why do banks push the 30 year loan term.

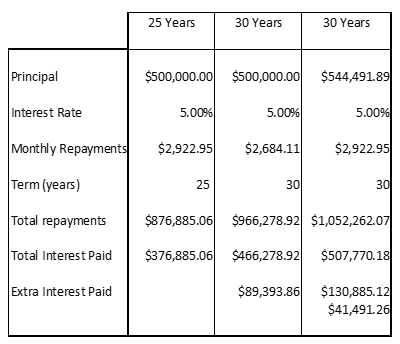

Apart from the fact that the banks earn more interest on a 30 year loan term (over $89,000 in this case), the other reason is that they can lend you more, so they earn even more interest.

The reason they can lend you more is that one of the things they consider when looking at you for a loan is your ability to make the monthly repayments – what they call loan serviceability.

Let’s say under the banks serviceability calculations, you could service $2,922.95 per month.

As the table shows, for a 25 year loan the maximum loan you could service was $500,000. But for a 30 year loan, you could service a loan of over $544,000, an increase of nearly 9%.

And the bank now makes an extra $130,885.12 in interest over the $500,000 25 year term (and an extra $41,491.26 over the $500,000 30 year term).

Now you can see why the banks push 30 year loan terms.

So which term do you choose?

I would say in terms of saving money, the 25 year term is best (usually by a long way).

But in the real world there are often other factors at play which impact on this decision.

One situation is that maybe you can only service the loan you want under the banks serviceability rules if it is a 30 year loan (remember the 30 year loan term has lower monthly repayments). So in this case, you need to make a decision. Do you lower your expectations and buy a cheaper house, or do you accept that it will cost you more in interest over the term.

Another situation, is that you may be wanting to de-risk the cashflow impact if one of the partners has time off work. For example to have and / or care for a baby. In this case you may want to have the lower loan repayments in this period when you may have lower incomes.

Or you may want to have extra borrowing capacity to buy and investment property.

Only you can make a decision as to what is best for you.

But if you take the 30 year loan option, here is what I suggest you do.

Start off by making your loan repayments as if it were a 25 year loan. So using the previous example, if Carey and Weeam take the $500,000 on a 30 year loan term, and their requirement monthly repayments are $2,684.11. Then I recommend that they try make monthly repayments of $2,922.95, which is the 25 year loan term.

That way you get the best of both worlds.

You get the serviceability based on the 30 year term and the interest savings of the 25 year term.

And if things change and you want to drop the repayment down, you are already ahead. Even if you make the higher repayments for the first 5 years you will save nearly $40,000 in interest.

So, don’t just accept what the banks or mortgage broker states as the loan term. Work which loan term suits you better and understand the trade-off between the longer term and the more money you will repay

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Register for my FREE Seminars and Webinars

FREE seminars and webinars with tips and strategies you can action today to get off the treadmill of working till you drop – plus time for your questions

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below