Wayne Wanders, The Wealth Navigator in the Media

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.

Media / Media Kit

Wayne Wanders, The Wealth Navigator in the Media

Radio Interview – why a simple bucket can revolutionise your thinking about your business – 15 January 2019

On Tuesday 15 January, I was interviewed by Alexi Boyd on Radio Station Triple H 100.1FM as part of Alexi’s Small Biz Matters Program. We are talking about why a simple bucket can revolutionise your thinking about your business.

If you want to learn how analysing and thinking about your business in buckets can help you profitably grow your business, click here or on the image below to go to the recorded podcast,

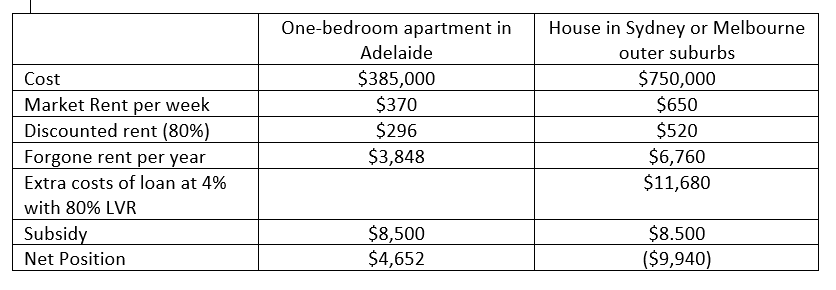

Labor’s “new” Affordable Housing Policy to put millions in the pockets of developers as they rip off gullible investors without solving the affordable housing problem in Sydney and Melbourne – 17 December 2018

Sydney Author, Chartered Accountant and international property investor Wayne Wanders, says that Labor’s “new” affordable housing policy will not solve the affordable housing problem in Sydney and Melbourne.

Mr Wanders said “that the so-called new policy announced by Labor over the weekend has not addressed two significant problems of a very similar policy implemented by the previous Rudd Government in its National Rental Affordable Scheme (NRAS).

“As someone who was working in this area at the time, NRAS had two glaring weaknesses which resulted in it being shut down”.

“The first and biggest problem is that the rebate is a fixed amount ($8,500 per year in the new policy) irrespective of the property size and location” said Mr Wanders

To demonstrate this, just compare a one-bedroom apartment in Adelaide with a house in an outer suburb of Sydney or Melbourne.

Mr Wanders said “that straight away you can see there is no real incentive for investors to fund affordable housing in Australia’s least affordable housing markets of Sydney and Melbourne”

“If you were an investor, the smart money will gravitate to lower cost properties in lower cost locations.”

“And the second problem is that the whole system was rorted by many developers” said Mr Wanders

Mr Wanders remembers looking at two potential investment properties for sale side by side on the one street. The houses were largely identical. One of the properties was being sold as registered under the NRAS scheme and the other was being sold just for normal investment. The NRAS property was being sold for nearly $50,000 more than the other identical property next door. The developer was increasing their margin simply because they had registered the property for NRAS.

Mr Wanders said ‘that this extra $50,000 margin to the developer, largely took away the benefit for the investor in the NRAS property and the house next door without NRAS was a better investment.”

“So only the gullible or ill-informed investor would buy the NRAS property”.

And these two factors alone show why Labor’s new Affordable Housing Policy will put millions in the pockets of developers as they rip off gullible investors. All without solving the affordable housing problem in Sydney and Melbourne” said Mr Wanders.

Superannuation boost in the Budget for some young and low income earners is a great start, but more still needs to be done – 8 May 2018

Author and Chartered Accountant Wayne Wanders, says the new mandatory rules released as part of the Budget, will go a long way towards helping stop the inappropriate erosion of the superannuation balances of young and low income workers currently getting paid super. Now all the Federal Government needs to do, is to remove the $450 monthly superannuation guarantee threshold so all low income earners, especially women can benefit.

Mr Wanders said, “For years, the superannuation balances of young and low income workers have been inappropriately eroded by unfair fees and charges and unnecessary or inappropriate insurance premiums”.

In announcing its Protecting Your Super Package as part of its 2018-19 Budget, Mr Wanders says, “The Federal Government is finally starting to take steps to stop this inappropriate erosion of people’s super”.

The biggest step that the Federal Government has taken is to place some mandatory controls around which members a superfund can automatically charge default insurance premiums. Currently, most superfunds have automatic opt in for their default insurance. That means, the member has to actively take steps to opt out of this default insurance.

“And as the industry knows, very few people actually do this” said Mr Wanders.

The Superannuation and Insurance Industry had belatedly recognised this as a problem and attempted in its recently released Insurance in Superannuation Code of Practice to head off this issue.

“But, thankfully for the young and low income workers, the Federal Government has not accepted this rather lame voluntary code of practice” said Mr Wanders.

Instead, from 1 July 2019, it will put in place its own mandatory standards, where superfunds can no longer automatically opt in a member into the fund’s default insurance programme if:

- The member is under 25 years of age;

- The member’s fund balance is less than $6,000; or

- The member has not had a contribution to their superfund account in the last 13 months and the account is inactive.

And on top of this, the Federal Government is taking action against the regressive fees most superfunds charge. From 1 July 2019:

- All exit fees on superannuation accounts are banned. No longer can your fund charge you to take your money out.

- A 3% cap applies on the administration fees on all superannuation accounts with balances below $6,000. That means someone with a superannuation fund balance of $1,000 can only be charged $30 in fees for the year, when they are currently paying at least $75 per year.

These new mandatory rules, will go a long way towards helping stop the inappropriate erosion of the superannuation balances of young and low income workers currently getting paid super. Now all the Federal Government needs to do, is to remove the $450 monthly superannuation guarantee threshold so all low income earners, especially women can benefit.

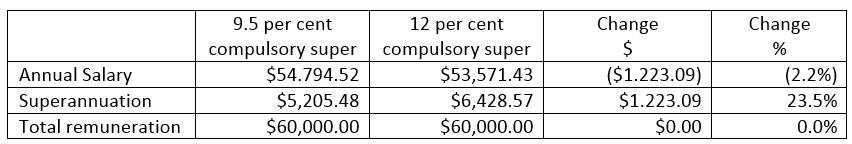

Private sector workers losers of SG increase – 1 May 2018

Author and Chartered Accountant Wayne Wanders, says most private sector workers don’t want superannuation guarantee increases as they will suffer a pay cut if they are pushed through.

Mr Wanders said “that in non-unionised private sector workplaces, the employer does not typically want to beholden to the federal government about what pay increase an employee should get”.

“It is common to see in a person’s employment agreement, the reference to a total remuneration package, inclusive of superannuation, that an employee is paid”.

“That means that if compulsory super is increased, the employee will get paid less salary” said Mr Wanders.

For example, on a remuneration package of $60,000 per annum inclusive of superannuation, this is how the employee would fare if compulsory super was increased to 12 percent.

Mr Wanders said “You can see why the financial services industry want the change. They get a 23.5 per cent increase in contributions before tax and probably a 20 per cent increase in fee income”.

“But the employee has their annual salary reduced by $1,223.09”.

“Which non-unionised private sector workers wants to have their take home pay reduced by 2.2 per cent today, on a politicians promise of more super in the future?” said Mr Wanders

Very few people. And that’s why most private sector workers don’t want superannuation guarantee increases.

And Money Management and their sister publication, Super Review has now published part of this release. Click below to see what was published in Money Management and Super Review.

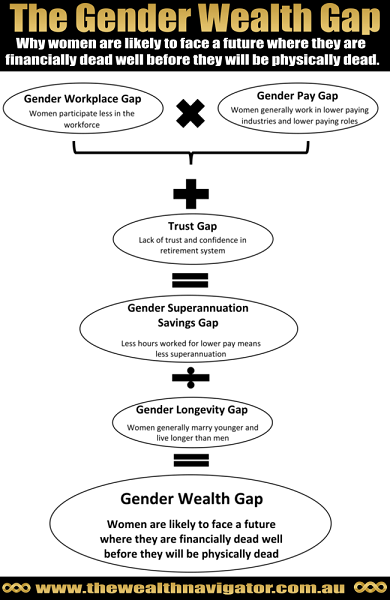

#MeTooForTheMoney – How to Beat the Gender Wealth Gap – 13 March 2018

A new report released today by Author and Chartered Accountant Wayne Wanders, shows it’s time to launch the #MeTooForTheMoney campaign to stop the women of Australia financially suffering from not being treated equally at work.

Mr Wanders said “And this unequal treatment can seriously impair a women’s ability to have the life in they deserve, and want, both today and in later years”.

“Whilst, the Gender Wealth Gap is continuing to close, we should be doing better”.

“We need to build on the current #MeToo movement and expand this to include financial equality for women. It’s about time we launched the #MeTooForTheMoney campaign” said Mr Wanders.

Mr Wanders said “as there are multiple causes of the Gender Wealth Gap, there is no one quick fix. It will require action by all areas of society to for the #MeTooForTheMoney campaign to beat the Gender Wealth Gap”.

In Mr Wanders report he details over 25 recommendations that the #MeTooForTheMoney campaign should focus on.

Click below to see a full copy of the Media Release.

So why not join me on Facebook at https://www.facebook.com/groups/MeTooForTheMoney and let’s launch the #MeTooForTheMoney campaign today and get financial equality for women sooner.

And Money Management has now published part of this release. Click below to see what was published in Money Management.

False and Misleading Information from Industry Super Australia – 28 February 2018

Author and Chartered Accountant Wayne Wanders, is claiming that a recent briefing note by Industry Super Australia titled “ATO Self-Managed Superannuation Funds – A Statistical Overview 2015-2016” contains false and misleading information.

In this briefing note, Industry Super Australia has states that “The average ROA (Return on Assets) for SMSF (Self-Managed Superannuation Fund) members (of 2.9 per cent for the 2015-2016 year) was on par with APRA regulated funds but below the 4.1 per cent achieved by industry funds during the same period”.

Mr Wanders said “In the Industry Super Australia’s briefing note, they are comparing the performance of industry funds excluding insurance premiums paid by members, with SMSF performance including insurance premiums paid by members”.

Mr Wanders said “Industry Super Australia are comparing apples with oranges”

“And this is either an example of poor research and analysis by Industry Super Australia, or a case of deliberate false and misleading reporting” said Mr Wanders.

Click below to see a full copy of the Media Release and why Mr Wanders believes the Industry Super Australia report is false and misleading

And Money Management and SMSF Adviser have now published part of this release. Click below to see what was published in Money Management and SMSF Adviser.

What’s the best way to close the gender gap in retirement incomes? – 10 February 2018

Analysis released today by Author and Chartered Accountant Wayne Wanders, shows that the Grattan Institute’s latest proposals to close the gender gap in retirement incomes will actually hurt more women than it helps.

Mr Wanders said “the key concepts of married life, being “happy wife, happy life” and “what’s hers is hers and what’s mine is hers” seem to have been forgotten by the Grattan Institute in its latest paper on the gender gap in retirement incomes. This paper was delivered by Mr Brendan Coates at the Australian Gender Economics Workshop, Perth, on 9 February 2018.

And as a result, the Grattan Institute’s proposals will hurt more women than it helps.

Click below to see a full copy of the Media Release and why Mr Wanders believes this proposal will hurt more women than it helps.

And Money Management has now published part of this release. Click below to see what was published in Money Management.

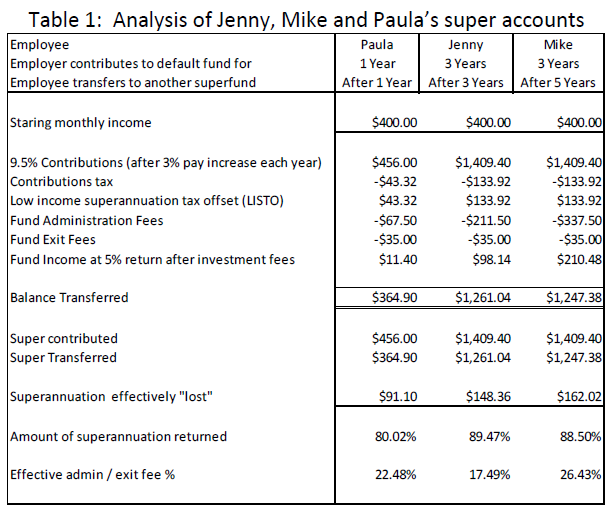

Who really wins if the $450 monthly earnings threshold for superannuation is removed? – 29 October 2017

Analysis by Sydney Author and Chartered Accountant Wayne Wanders shows that unless regressive fees charged by superannuation funds like administration and exit fees are removed, it will be the superfund, not the low income earner who wins.

Mr Wanders said there has been a lot of talk lately about removing the $450 monthly earnings threshold for superannuation.

“Fundamentally, there are a lot of reasons why it makes sense to remove this threshold and have all employees get paid superannuation irrespective of what they earn. But this change has to be made properly, or the only real winners from this change will be the superannuation funds themselves” said Mr Wanders.

Why? Mr Wanders said most superannuation funds, whether they are retail or industry funds, charge regressive administration and exit fees. These fees are the same whether you have $500 or $50,000 in superannuation.

“And what’s worse, these regressive fees eat away quickly at the superannuation balances of low income earners” said Mr Wanders.

To demonstrate this, Mr Wanders provided the example of three people who are just about to start working part time at a local pool teaching people to swim. They are Mike and Jenny, both 18 and just about to start their first year of university and want some party money, and Paula, a 35 year mother, wanting some part time work whilst her kids are at school.

“So if we really have low income earners superannuation balances at heart, not only should we remove the $450 monthly earnings threshold for superannuation, but we should also remove the regressive fees such as administration and exit fees, charged by retail and industry super funds alike” said Mr Wanders.

Click below to see a full copy of the Media Release

And Money Management has now published part of this release. Click below to see what was published in Money Management.

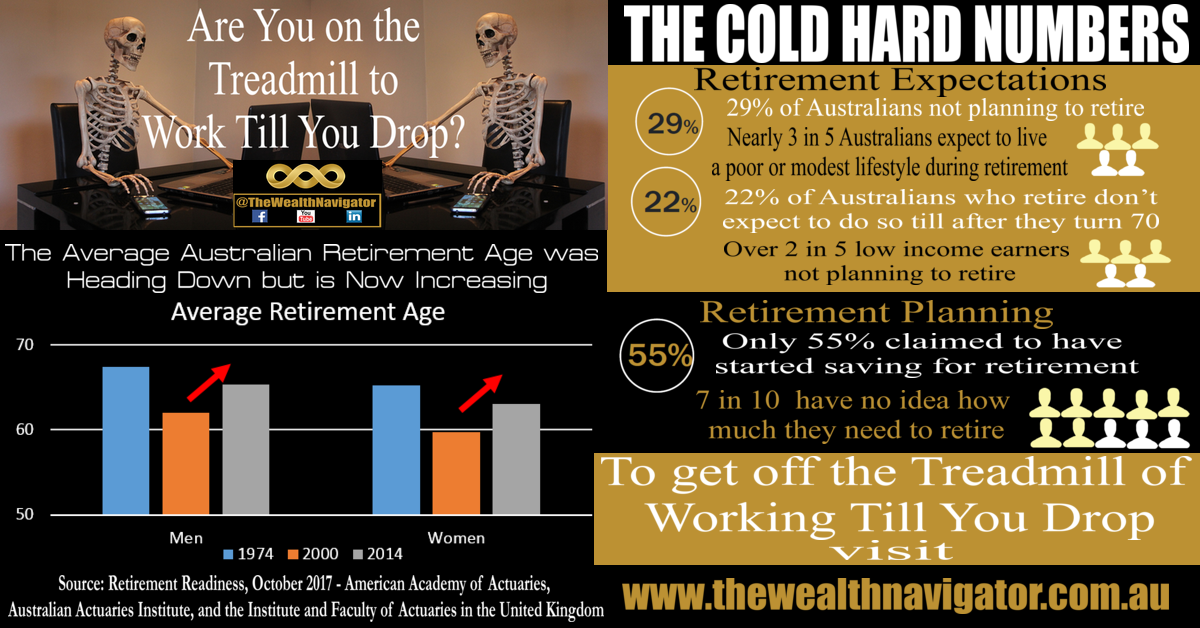

Despite 25 years of Compulsory Superannuation in Australia, most people remain on the Treadmill to Work Till They Drop.

– 18 October 2017

The Retirement Readiness Report, by the American Academy of Actuaries, the Australian Actuaries Institute, and the Institute and Faculty of Actuaries in the United Kingdom issued this week, concludes that inertia and procrastination are driving a lack of preparation for retirement.

Author and Chartered Accountant Wayne Wanders, said that the overall effectiveness of the superannuation system in Australia needs to be reconsidered in the light of the Retirement Readiness Report’s Australian findings, summarised in the infographic, which include:

- the average age of retirement is increasing;

- many people are planning not to retire at all;

- most are planning to retire gradually rather than fully;

- many are planning to retire after they turn 70; and,

- relatively few are expecting a comfortable lifestyle in retirement.

“Despite 25 years of compulsory superannuation, most Australians remain on the treadmill to work till they drop” said Mr Wanders.

“This lack of engagement through inertia and procrastination, means that the compulsory superannuation system is failing in its efforts to get the majority of Australians off the pension.”

Click below to see the full version of the media release.

And Money Management has now published part of this release. Click below to see what was published in Money Management.

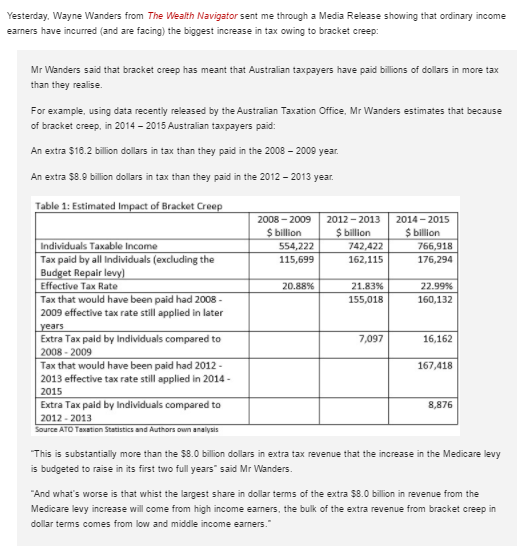

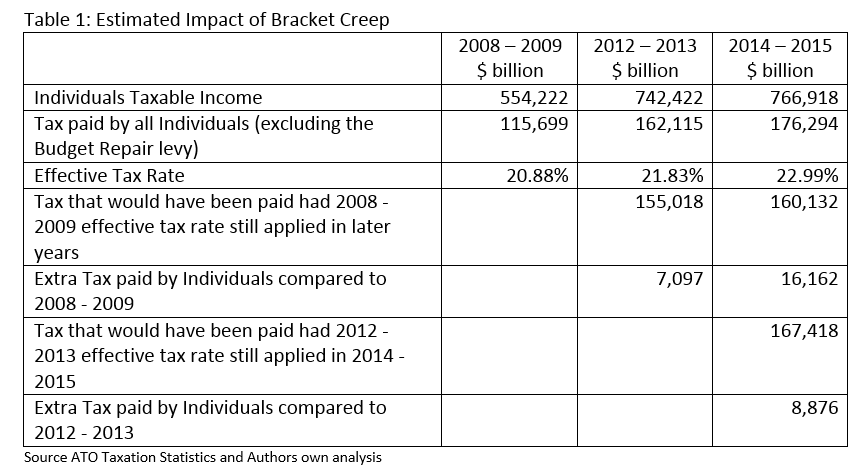

Bracket Creep, the taxman’s silent and insidious tax collector – 16 May 2017

Australian Low and Middle Income Earners should be more worried about the taxman’s silent and insidious tax collector, “Bracket Creep”, than about the extra Medicare levy they may soon face.

Analysis by Sydney Author and Chartered Accountant Wayne Wanders shows that the bracket creep hurts low and middle income earners more than the proposed increase in Medicare levy included in the recent Budget.

Mr Wanders said that bracket creep has meant that Australian taxpayers have paid billions of dollars in more tax than they realise.

For example, using data recently released by the Australian Taxation Office, Mr Wanders estimates that because of bracket creep, in 2014 – 2015 Australian taxpayers paid:

- An extra $16.2 billion dollars in tax than they paid in the 2008 – 2009 year.

- An extra $8.9 billion dollars in tax than they paid in the 2012 – 2013 year.

“This is substantially more than the $8.0 billion dollars in extra tax revenue that the increase in the Medicare levy is budgeted to raise in its first two full years” said Mr Wanders.

“And what’s worse is that whist the largest share in dollar terms of the extra $8.0 billion in revenue from the Medicare levy increase will come from high income earners, the bulk of the extra revenue from bracket creep in dollar terms comes from low and middle income earners.”

What is Bracket Creep?

To understand what bracket creep is, Mr Wanders provided the following example of Fred who is on a base salary of $75,000.

In the 2014-15 year Fred got an annual bonus above his base salary of $5,000. On that $5,000 Fred paid tax and Medicare levy of $1,725. So he pocketed $3,275 of the bonus or 65.5% of his gross bonus.

In the 2015-2016 year Fred’s salary did not change, but his bonus was $10,000. On this bonus, Fred now pays $3,675 in tax and Medicare levy. So out of the $10,000 bonus, Fred pockets $6,325, which is now only 63.25% of his gross bonus.

Now tax rates did not change between 2014-2015 and 2015-2016 but the effective rate of tax on Fred’s bonus went from 34.5% to 36.75%.

And that is what bracket creep is, said Mr Wanders. “It is where a person pays a higher rate of tax as their income increases but the tax thresholds where tax rates change do not move”.

“And until tax thresholds are indexed with wage increases, bracket creep is the taxman’s silent and insidious tax collector.”

Click below to see a full copy of the Media Release

The Real Cost of Negative Gearing – 12 April 2017

A new report released today by Sydney Author and Chartered Accountant Wayne Wanders shows that the real cost of Negative Gearing by “mum and dad” property investors is significantly less than other benefits provided by the Federal Government.

Mr Wanders said that the impact on the Federal Government’s budget of nearly 1.3 million individual “mum and dad” taxpayers who had negatively geared properties in the 2014- 2015 tax year was $1.6 billion dollars.

“This is substantially lower than the $5.0 billion dollar cost to the Federal Government’s budget of the 8.6 million taxpayers who claimed nearly $21.9 billion dollars in work related expenses in the 2014-2015 tax year” said Mr Wanders.

“And this is also significantly lower than spending in the 2015-2016 year on welfare items like the $7.4 billion dollars spent on the Child Care Rebate; the $20.9 billion dollars spent on the Family Tax Benefit; the $2.0 billion dollars spent on Parental Leave or the $6.2 billion dollar Private Health Care Rebate.”

“And this pails into insignificance when you realise that the Federal Government in 2014-2015 pocketed nearly an extra $5.5 billion dollars in income tax from individual taxpayers through bracket creep.”

Mr Wanders was able to use the Australian Tax Office’s own data from its recent release of the 2014-2015 Taxation Statistics, to determine in excess of $9.0 billion dollars of economic benefit to the Australian economy from these nearly 1.3 million individual “mum and dad” taxpayers.

“So for every dollar the Federal Government “assists” these taxpayers, they contribute over five dollars to the Australian economy.”

“All of which leads to the conclusion, that the 1.277 individual “mum and dad” taxpayers who negatively gear investment properties, are not costing the Australian economy and in fact are significantly contributing.”

Click below to see the full version of the media release and report “The Real cost of Negative Gearing“

Why Most Women Will Be Financially Dead Before They Are Physically Dead – 7 March 2017

Why most women will be financially dead before they are physically dead

A new report released today by Author and Chartered Accountant Wayne Wanders, shows due to the collision of a perfect storm with a tsunami, women are at risk of having a twice as long retirement than men, on around half the money.

Mr Wanders said that “As a result, women are more likely than men to face a future where they are financially dead well before they will be physically dead.”

“And between this period of financial death and physical death, women are a great risk of experiencing significant stress from living in poverty.”

Watch the video below to not only understand why most women will be financially dead before they are physically dead, but more importantly, learn how to avoid being caught in this gender gap.

Alternatively, click below the video to see the full version of the media release and the full copy of the report.

More Fake News About Self-Managed Super Funds (SMSF’S) – 27 February 2017

More Fake News About Self-Managed Super Funds (SMSF’S)

Sydney Author and Chartered Accountant Wayne Wanders, has stated that the report “ATO SMSF Annual Briefing 2016” and the associated media release recently issued by Industry Super Australia shows that it is not just America which suffers from Fake News.

Mr Wanders said that “the Industry Super Australia (ISA) economists are comparing apples with oranges when they compare the 2015 performance of Self-Managed Superannuation Funds (SMSF’s) with the performance of Australian Prudential Regulation Authority (APRA) regulated funds.”

“The ISA economists are using SMSF return data provided by the Australian Taxation Office (ATO) to substantiate their claims that APRA regulated funds, and industry funds in particular perform better than SMSF’s, including asserting that SMSF’s with less than $2 million in assets is unviable.”

“But there are a couple of significant differences between how the ATO measures the return of a SMSF, verses how the returns of APRA regulated funds are measured” said Mr Wanders.

“Firstly, the ATO includes member’s insurance premiums as an expense when determining the return of a SMSF. These are not included in the returns of APRA regulated funds.”

“And secondly, the returns quoted by APRA regulated funds do not include the administration fees APRA regulated funds typically charge their members outside of their investment earnings.”

Mr Wanders said “These differences have the effect of understating SMSF returns and overstating the returns provided by APRA regulated funds. And because of this, the key conclusions drawn by the ISA economists about the viability or otherwise of SMSF’s are misleading to people who are considering setting up a SMSF.”

“A classic case of Fake News.”

Click below to see the full version of the media release.

The Real Reason for Sydney’s House Price Growth – 30 January 2017

The Real Reason for Sydney’s House Price Growth – Is successive governments under investment in creating jobs in Regional Australia

A new report released today by Sydney Author and Chartered Accountant Wayne Wanders, shows that Mum and Dad negative geared property investors are not behind the rise in Sydney Property Prices.

Mr Wanders said that “if the same negative gearing tax laws exist across Australia, why can Sydney house prices rise 94 per cent in the last 10 years, but Brisbane house prices only increase by 51 per cent and only 12 per cent in Perth.”

“Why can Sydney house prices go up significantly higher than regional NSW when the same rules are in place?”

“The facts show that negative geared Mum and Dad investors are not the prime reason behind the growth in Sydney house prices” said Mr Wanders.

Mr Wanders believes that the real cause of Sydney’s house price growth, is that successive governments have under invested in regional towns to drive jobs growth in those towns.

“And this lack of jobs is pushing people back into Sydney, placing pressure on Sydney’s housing stock and driving up house prices”.

Click below to see the full version of the media release and report “The Real Reason For Sydney’s House Price Growth“

People Need to Realise That Superannuation Will Not be Enough for Retirement 4 October 2016

People Need to Realise That Superannuation Will Not be Enough for Retirement

All these promises about a golden retirement on the back of your current superannuation are lies. A fraud. It will never happen. 9.5 per cent superannuation contribution will never get you there.

Author of the book Avoid the Poverty Trap and Chartered Accountant, Wayne Wanders said most Australians are on the treadmill to work hard all their life, just to retire poor. Heading straight for what Mr Wanders calls the Poverty Trap.

Mr Wanders said the reason is fairly simple, a 9.5 per cent contributions level will never be enough!

Click below to see why your super will never be enough!

Superannuation’s importance to retirement savings is significantly understated by new Grattan Institute Research? 4 October 2016

Superannuation’s importance to retirement savings is significantly understand by new Grattan Institute research

The reality is that Superannuation continues to be one of the most important asset classes for retirement

Author of the book Avoid the Poverty Trap and Chartered Accountant, Wayne Wanders said that conclusions drawn by the Grattan Institute in its recently released report How Households Save for Retirement are flawed.

Click below to read the full media release

The Secret about Your Superannuation 3 August 2016

The Secret about your superannuation that the government, the banks and the unions do not want you to know!

All these promises about a golden retirement on the back of your superannuation are lies. A fraud. It will never happen. The Retirement System in Australia is broken.

Mr Wanders said they want to keep it a secret “because between them, the Government, the banks and the unions have to be pulling over $15 billion dollars a year out of superannuation. And if you knew the truth, you might put your money somewhere else. Or you might want some accountability and we all know how much the government, the banks and the unions hate being held accountable for what they do.”

Click below to read the full media release.

Is Negative Gearing an Investment Property a Drain on the Australian Economy? And should the tax rules be changed as a result? 19 April 2016

A new report released today (19 April 2016) by Sydney Author and Chartered Accountant Wayne Wanders shows that the economic benefit to the Australian economy by taxpayers who have negatively geared property is substantially higher than the income tax “subsidy” they receive.

Mr Wanders said that the 1.2 million individual taxpayers who had negatively geared properties in the 2013 – 2014 tax year contribute in excess of $10 billion dollars annually in economic benefit to the Australian economy.

“This is substantially higher than the estimated $2.6 billion dollar income tax “subsidy” these 1.2 million taxpayers received,” said Mr Wanders.

Northern District Times 22 July 2015

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.

Do you and your family a favour and start now.

Wayne Wanders The Wealth Navigator

wayne@thewealthnavigator.com.au