Bracket Creep, the taxman’s silent and insidious tax collector – Part of the Rigged System

Australian Low and Middle Income Earners should be more worried about the taxman’s silent and insidious tax collector, “Bracket Creep”, than about the extra Medicare levy they may soon face.

Analysis by Sydney Author and Chartered Accountant Wayne Wanders shows that the bracket creep hurts low and middle income earners more than the proposed increase in Medicare levy included in the recent Budget.

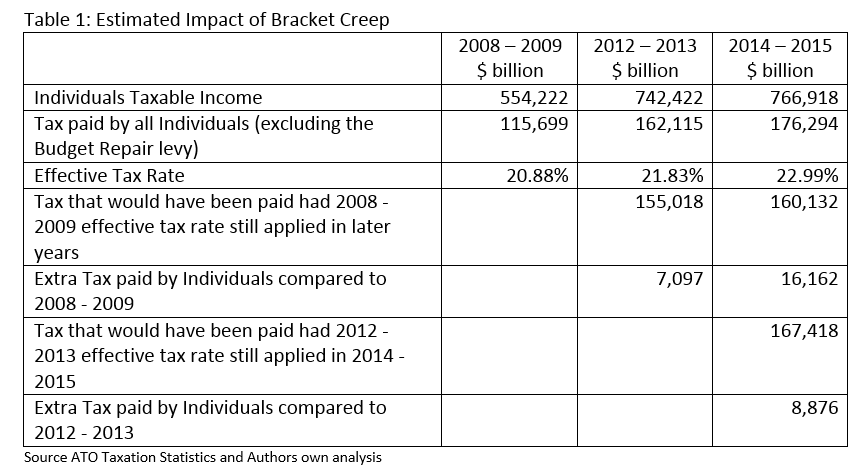

Mr Wanders said that bracket creep has meant that Australian taxpayers have paid billions of dollars in more tax than they realise.

For example, using data recently released by the Australian Taxation Office, Mr Wanders estimates that because of bracket creep, in 2014 – 2015 Australian taxpayers paid:

- An extra $16.2 billion dollars in tax than they paid in the 2008 – 2009 year.

- An extra $8.9 billion dollars in tax than they paid in the 2012 – 2013 year.

“This is substantially more than the $8.0 billion dollars in extra tax revenue that the increase in the Medicare levy is budgeted to raise in its first two full years” said Mr Wanders.

“And what’s worse is that whist the largest share in dollar terms of the extra $8.0 billion in revenue from the Medicare levy increase will come from high income earners, the bulk of the extra revenue from bracket creep in dollar terms comes from low and middle income earners.”

What is Bracket Creep?

To understand what bracket creep is, Mr Wanders provided the following example of Fred who is on a base salary of $75,000.

In the 2014-15 year Fred got an annual bonus above his base salary of $5,000. On that $5,000 Fred paid tax and Medicare levy of $1,725. So he pocketed $3,275 of the bonus or 65.5% of his gross bonus.

In the 2015-2016 year Fred’s salary did not change, but his bonus was $10,000. On this bonus, Fred now pays $3,675 in tax and Medicare levy. So out of the $10,000 bonus, Fred pockets $6,325, which is now only 63.25% of his gross bonus.

Now tax rates did not change between 2014-2015 and 2015-2016 but the effective rate of tax on Fred’s bonus went from 34.5% to 36.75%.

And that is what bracket creep is, said Mr Wanders. “It is where a person pays a higher rate of tax as their income increases but the tax thresholds where tax rates change do not move”.

“And until tax thresholds are indexed with wage increases, bracket creep is the taxman’s silent and insidious tax collector.. Rigging the system in favour of the Government all the time.”

Click below to see a full copy of the Media Release

Register for my FREE Wealth Truth Webinar

FREE online webinar with 4 key tips and tricks to beat the rigged system – plus time for your questions

Do you and your family a favour and start taking steps so you can improve the health of your wealth.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au