Why Labor’s negative gearing reforms will not make Sydney housing more affordable

Introduction

The Australian Labor Party has proposed a policy of negative gearing reforms if it wins the next Federal election in order to make housing more affordable in cities like Sydney.

These negative gearing reforms aim to restrict negative gearing to new properties only. Investments in existing properties, shares or other investments will no longer be able to be negatively geared.

Negative gearing is the simply the ability to offset investment losses against other income such as salary and wages.

In the case of property, it means that the rent received is less than the expenses incurred such as interest, insurance, rates, water. Investors are willing to do this because they are hoping this annual loss is more than compensated for by appreciation in value via capital gains. This annual loss is used to reduce a person’s overall taxable income and reduce the amount of income tax that person pays.

Why Labor’s change to negative gearing will not make Sydney housing more affordable

Nobody can predict with any certainty what will happen if Labor is able to implement its proposed negative gearing reforms.

The best proxy I believe is to examine recent history to see if negative gearing was a large factor in the housing affordability issues faced in cities like Sydney.

It is important to note that the current negative gearing tax laws are uniform across Australia. There is no tax incentive to invest Auburn in Sydney, over investing in Zeehan in Tasmania. The laws are the same and you get the same negative gearing tax benefits in both locations.

So, if negative gearing was a large factor contributing to the housing affordability issues seen in Sydney over the recent past, you would expect to see somewhat similar property price trends across Australia.

But this is not the case!

Capital City Price History

Let’s start with looking at what has happened with Capital City house prices.

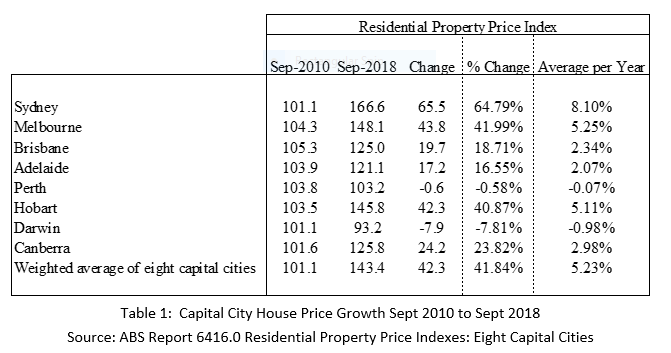

According to the Australian Bureau of Statistics (ABS) data, house prices across Australia’s capital cities increased by nearly 42 percent between September 2010 and September 2018. You have to agree that this is a significant increase in just eight years.

But as you can see in the below table this growth has not be consistent across all capital cities. For example, Sydney grew by nearly 65 percent whilst Perth and Darwin actually went backwards.

As was mentioned previously, the current negative gearing tax laws are uniform across Australia. Whether you own a property in Bondi in Sydney, Fannie Bay in Darwin or in Cottesloe in Perth, the negative gearing tax treatment is the same.

So, if the tax treatment is the same across negatively geared property in Australia, how can negative gearing be the main factor behind Sydney house prices growing by 65 percent but have no impact on Perth and Darwin house prices? How can uniform negative gearing laws result in house prices in Hobart increasing by more than double what prices in Brisbane grew.

This would tend to suggest that factors other than negative gearing are having a significant impact on house price growth in Sydney, when compared with other capital cities.

And if this is the case, then Labor’s negative gearing reforms are unlikely to achieve its objective of improving housing affordability in Sydney.

Regional NSW Price History

What about what has happened in regional NSW as compare to Sydney.

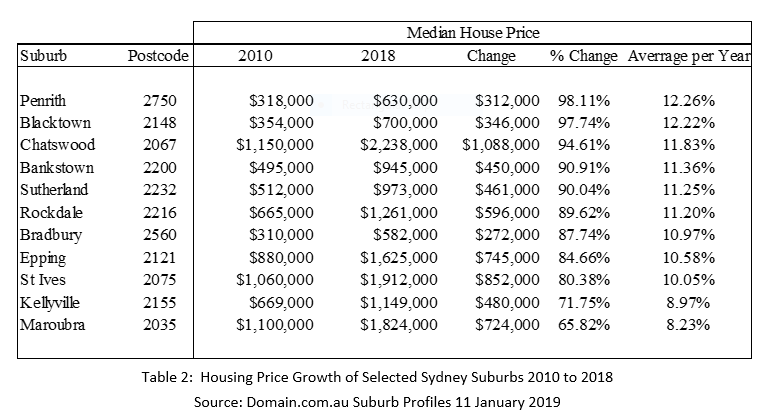

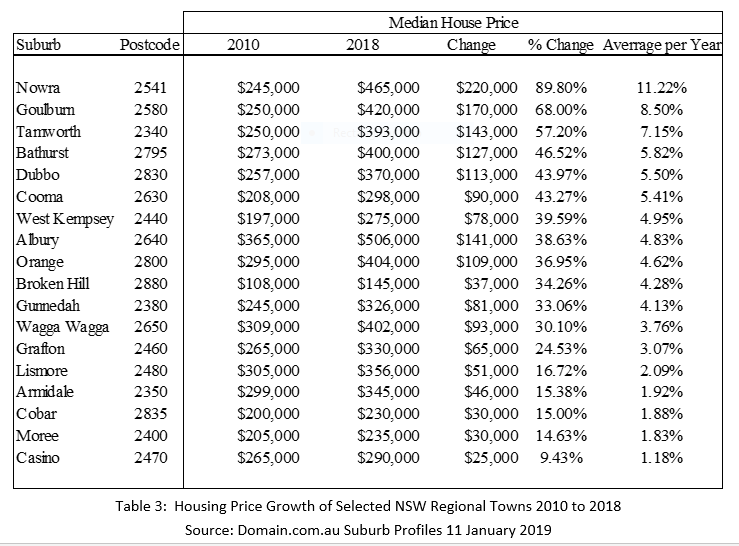

As you can see from the below tables, the house price growth rate in various Sydney suburbs over the past eight years, is much higher than the housing price growth rates seen in many regional towns in NSW for the same period.

So, if the tax treatment is the same across negatively geared property in Australia, how can negative gearing be the main factor behind Sydney house prices growing substantially more house prices in regional NSW cities and towns? How can uniform negative gearing laws result in house prices in Bankstown increasing by more than double what prices in Bathurst grew.

This would tend to suggest that factors other than negative gearing are having a significant impact on house price growth in Sydney, when compared with regional NSW cities and towns.

Once again this would tend to suggest that factors other than negative gearing are having an impact on house price growth in Sydney verses regional NSW, and that Labor’s negative gearing reforms are unlikely to achieve its objective of improving housing affordability in Sydney.

Conclusion

As the data from the ABS at capital city level and Domain at individual suburb, city or town level shows, house price growth in Sydney has been substantially higher than most parts of Australia.

And based on the fact that negative gearing tax laws are consistent across Australia, the only conclusion I can draw from this, is that factors other than negative gearing are having an impact on housing affordability in Sydney.

So, if negative gearing is not a significant factor in causing the housing affordability issues in Sydney, then Labor’s negative gearing reforms are unlikely to achieve the objective of improving housing affordability in Sydney.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below