Super Salary Sacrificing – What is it and should you do this

What is Super Salary Sacrificing?

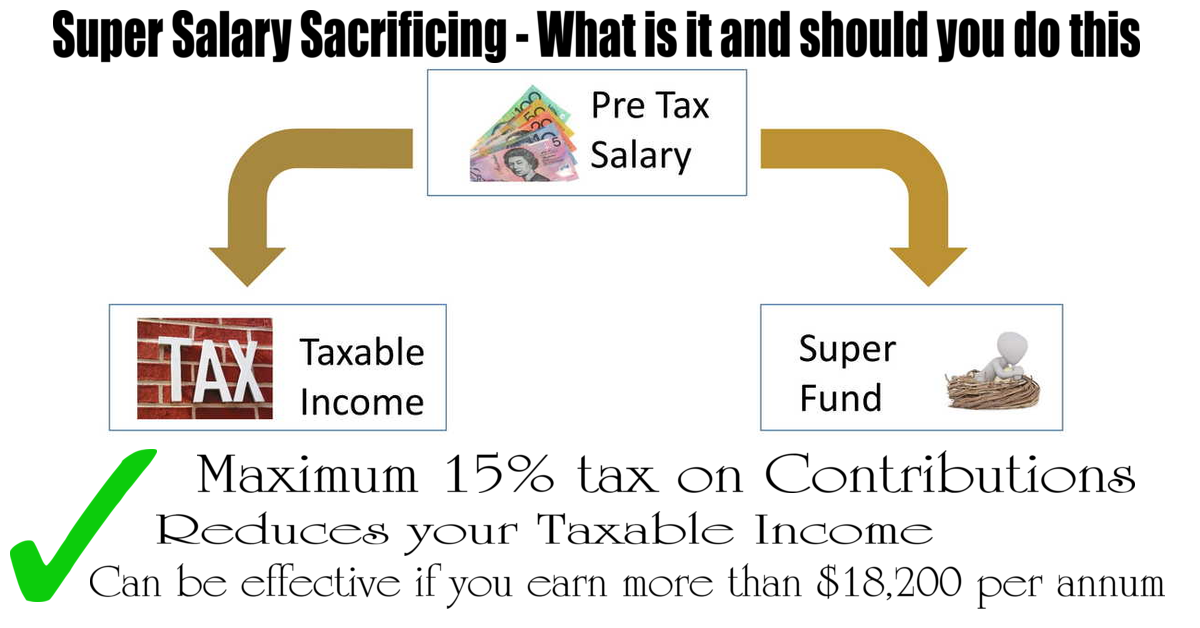

Super salary sacrificing is when you give up a part of your pre-tax income and instead have this paid to your superannuation fund.

The Old Way of Super Salary Sacrificing

Previously, the only way to salary sacrifice was to get your boss to do this for you.

For example, you are currently on an income of $120,000 per year and your employer pays $11,400 (being 9.5% of your income) in compulsory super for you, and you now want to salary sacrifice an extra $12,000 in superannuation per annum. You instruct your pay office that you want to do this.

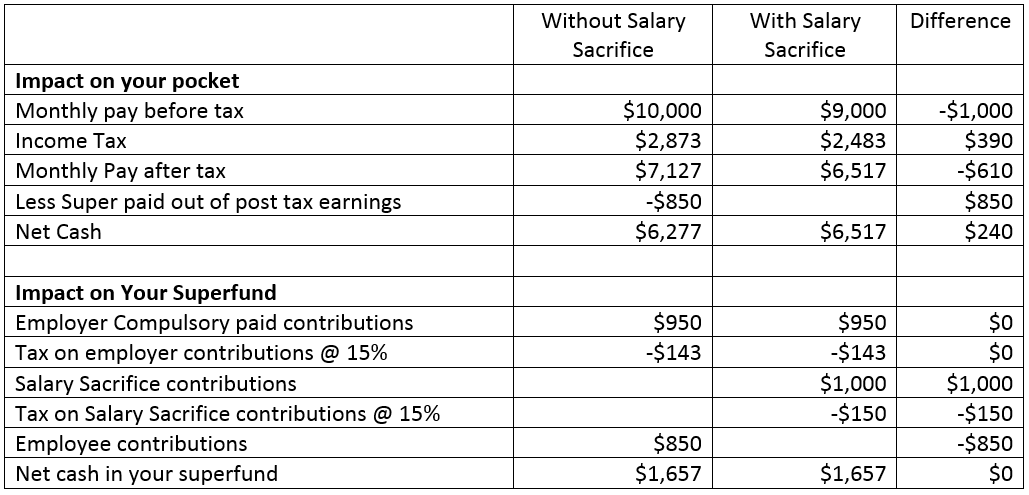

Before your decision to salary sacrifice into your super, your employer paid you $10,000 before tax and $7,127 after tax per month. Your employer would contribute $950 to your superfund.

By salary sacrificing $12,000 per annum, your monthly pay before tax drops to $9,000 and to $6,517 after tax. Your employer would now contribute $1,950 to your superfund.

The New Way of Super Salary Sacrificing

Getting your boss to handle any super salary sacrifice was fraught with many issues. These included:

- Some bosses did not want the hassle of doing this so did not offer the ability to salary sacrifice to their staff.

- Some bosses offset your salary sacrifice against their compulsory superannuation obligations, effectively short changing you on super.

- Other bosses may not have paid this for 3 to 4 months to your superfund. So you were out of pocket but the money was in the boss’s bank account and not your superfund.

- Some bosses may not have paid it at all, going broke after they took the money from your pay packet and before they put the money in your superfund.

And because of this, it put many people off from super salary sacrificing.

Well the laws have changed effective 1 July 2017.

And these new laws allow you to take your boss out of the equation.

You no longer need to ask your boss to make the salary sacrifice payments. You can now take control and elect to make super payments directly to your super fund when you want to and claim a tax deduction for these on your tax return. These payments can be regular amounts or just a once off payment.

So you could have your boss pay your employer contribution of each quarter and in June work out if you want to make a once off payment to your superfund. Or you could be putting $50 a week extra into your super and in June decide if you want to make a separate top up payment.

Should You Do Super Salary Sacrificing?

The reason people do super salary sacrificing is because it is a tax effective way to put money into super. The easiest way to show this is with an example.

In this example, you personally ended up with the same after tax contribution in your superfund, but you ended up with $240 more in your pocket each month.

That is free money to you just by changing how you contribute to your super.

But will Super Salary Sacrificing work for everyone?

No.

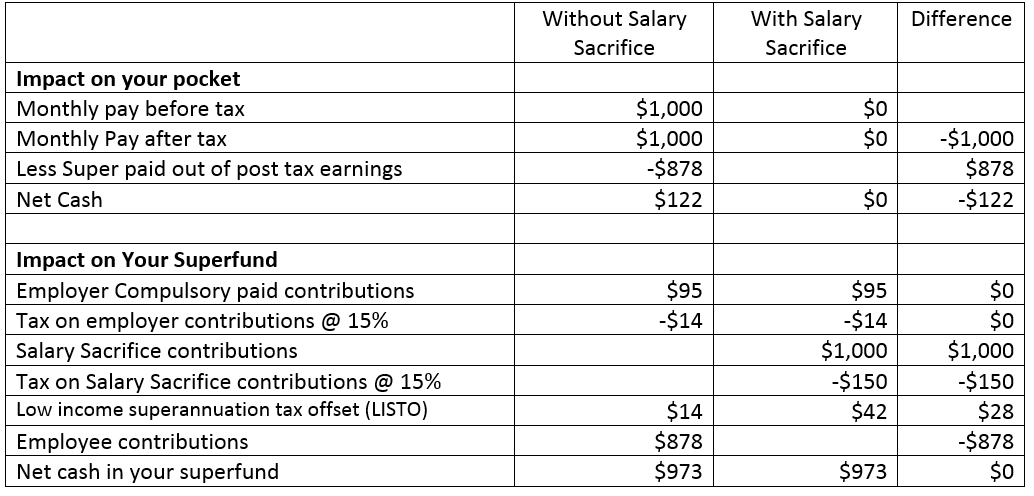

The reason why is you are arbitraging between your marginal tax rates and the 15% tax on super contributions. So for low income workers it does not make much sense. Let’s use an example of someone on $12,000 per annum who does not pay any tax and wants to salary sacrifice the whole amount.

In this case, this person ended up with the same contribution in their superfund after tax, but ended up with $122 less in their pocket each month. So why would you do this?

So I would not recommend anyone who earns less than $18,200 to salary sacrifice. Above this, you would need to work out the benefits to see if it is worth doing it.

Are there rules around Super Salary Sacrificing?

Yes.

Firstly, you need to make sure you tell your superfund that you are claiming a tax deduction on these payments. And don’t forget when you do your tax return, to claim these payments as a tax deduction!

Secondly, the money must be banked by the superfund in the year. There is no point sending a cheque on 30 June and wanting the money included in that years contributions. It needs to be banked by the superfund in that year.

Thirdly, there is a cap on how much can be contributed to your superfund from employer and salary sacrifice contributions. For the 2017-2018 year this is $25,000. So you need to make sure you do not exceed this, otherwise any benefit will be lost. This is because the contributions above $25,000 get added to your assessable income and you pay tax at your marginal rates less a 15% tax offset.

The last thing you may need to consider is the timing of when you get the tax saving. Potentially you won’t get the tax saving till you lodge your tax return. If you are worried about this, you can lodge a PAYG withholding variation application with the Tax Office and this will adjust the tax taken out of your pay by your employer each pay period.

Would I do Super Salary Sacrificing?

Now in another blog I will compare putting extra into your super v’s extra into your mortgage v’s investing. You will see in that blog, in some instances salary sacrificing to super is one of your best options.

So if this was me, I would want control and certainty and would manage the process myself. I would not generally leave it to my employer, unless you know they make the payments in line with when they pay you.

And if you wanted to do a weekly payment, just set up a direct debit between your bank account and your superfund. Talk to your superfund and work out how to arrange this.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Register for my FREE Seminars and Webinars

FREE seminars and webinars with tips and strategies you can action today to get off the treadmill of working till you drop – plus time for your questions

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below