Submission to Banking Royal Commission

With all the talk about the banks and big finance companies at the Banking Royal Commission, I want to highlight that the issues go beyond them. Here is a copy of my submissions to Banking Royal Commission about what I believe is false and misleading marketing by Industry Super Australia.

This submission to the Banking, Superannuation and Financial Services Industry Royal Commission is directed at Industry Super Australia Pty Ltd ABN 72 158 563 270 (ISA). ISA describe themselves as a research and advocacy body for Industry SuperFunds and they promote these Industry Funds to current and potential superannuation members.

Under the consumer protection laws of Australia, the Competition and Consumer Act 2010, businesses are not allowed to make statements that are incorrect or likely to create a false impression.

I believe that ISA is in breach of these consumer protection laws in a number of areas on its website (https://www.industrysuper.com), and as such ISA, in my opinion, is guilty of misconduct that may be of interest to the Banking, Superannuation and Financial Services Industry Royal Commission.

The details of the misconduct by ISA in the superannuation industry in Australia are noted below.

Compare the Pair Advertising

ISA on its website has a page dedicated to comparing between the average Industry SuperFund and the average retail super fund.

This is at https://www.industrysuper.com/compare/compare-the-pair/.

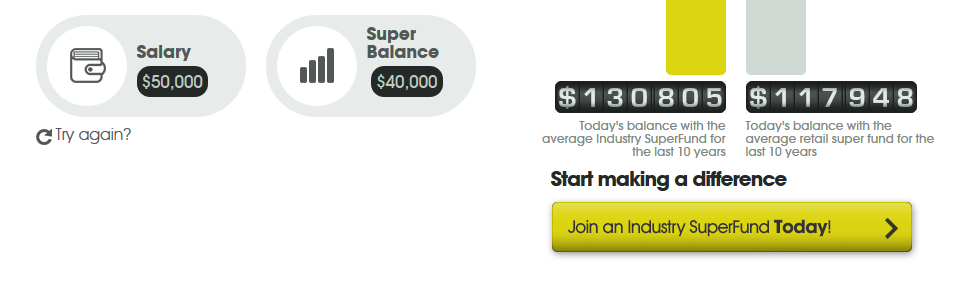

If you visit this page and complete the calculator to “see the BIG difference for yourself” you are presented with a screen that looks like the following:

Source https://www.industrysuper.com/compare/compare-the-pair/ 10.00am 8 April 2018

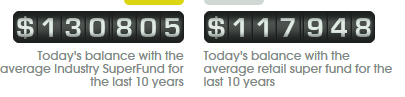

The key area where I believe that ISA is guilty of misconduct and of creating a false impression is in the use of the words “Today’s balance with …………”

This gives the visitor the impression that after 10 years their superannuation balance will be the amount quoted. This is my opinion is creating a false impression because it leaves out one very important aspect.

And that aspect is insurance.

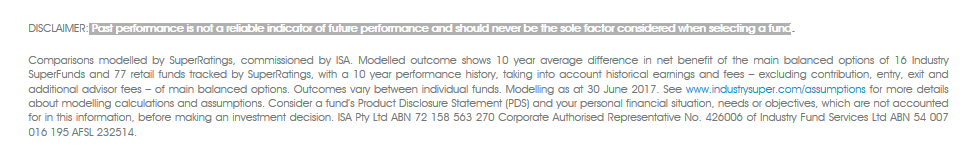

A lot of superannuation funds have insurance as an automatic opt in product and this will reduce the balance of the person’s superannuation account. You would expect to see such a disclaimer on the applicable web page in relation to this comparison excluding insurance. But you don’t. Here is the disclaimer details on the applicable page.

Source https://www.industrysuper.com/compare/compare-the-pair/ 10.00am 8 April 2018

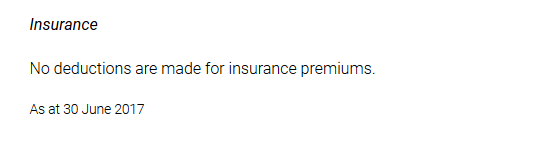

Instead you have to go to the page https://www.industrysuper.com/footer/assumptions/ and in the very last assumption you will find the comment that no deductions are made for insurance premiums.

Source https://www.industrysuper.com/footer/assumptions/ 10.00am 8 April 2018

So why is this giving a false impression?

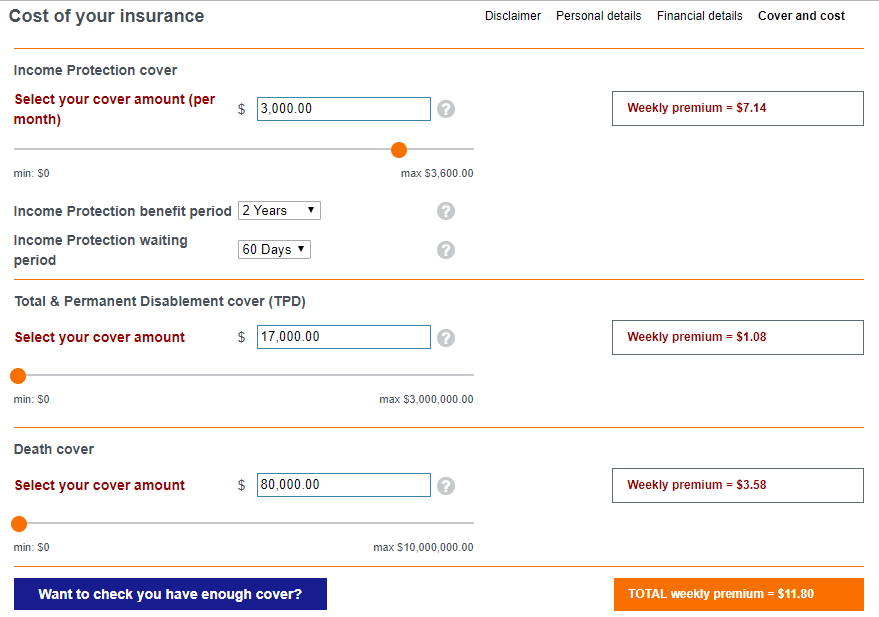

Insurance premiums can dramatically change the balance of a person’s superannuation account over time. Using the example of a 50 year old blue collar worker earning $50,000 and taking the automatic default cover under Australian Super’s guidelines, the weekly premium is $11.80.

Source https://www.uwplus.com.au/MOL/PremiumEstimate/PremiumEstimate.aspx 8 April 11.00am

This equates to $613.60 per annum. If this insurance premium grows at 2.5% per annum and the fund reports 5% income per annum, this will reduce the balance of that persons superannuation account by nearly $9,000.

In the example above it would change the “Today’s balance with the average Industry Superfund” from $130,805 to $122,029 – a drop of nearly 7% – which in anyone’s language is a large and material number.

And I am sure that the average retail super fund balance would change as well.

So whilst the overall comparison may not change, the “Compare the Pair” marketing undertaken by ISA and shown on their website, means that ISA, in my opinion is making statements that are incorrect or likely to create a false impression as to someone’s superannuation balance in 10 years time..

To eliminate this false impression, ISA should more prominently disclose that the balance does not include the adverse impact of insurance premiums

Self-Managed Super (SMSF)

ISA has a page on its website, https://www.industrysuper.com/understand-super/self-managed-super/ that looks at self-managed superannuation funds (SMSF).

The page draws on data provided by the Australian Taxation Office (ATO) in its report “ATO SMSFs: A statistical overview 2015-2016” and provides some comparison between returns and expense ratios of SMSF’s and industry superfunds.

And the website specifically states “ATO and APRA data also shows that industry super funds have outperformed all SMSF fund size categories on an annualised basis”

Source https://www.industrysuper.com/understand-super/self-managed-super/ 8 April 11.30am

In my opinion, the ISA is making statements that are incorrect or likely to create a false impression in relation to the performance of SMSF’S.

The basis of this opinion is that ISA are comparing apples with oranges and not telling anyone about this.

The apples are the returns reported by APRA and industry funds which are exclusive of member’s insurance premiums.

The oranges are that the returns reported by the ATO in its analysis of SMSF performance are net of member’s insurance premiums. The inclusion of the member’s insurance premiums has been confirmed in email by the ATO to me personally. The exact response I have received from the ATO SPR SMSF Stats team was “In the 2014-15 and 2015-16 reports, insurance premiums members are part of the ‘total expenses’ and the ‘total investment expenses’ category.”

So ISA is in my opinion, making statements that are incorrect or likely to create a false impression when it compares the performance of industry funds excluding insurance premiums paid by members, with SMSF performance including insurance premiums paid by members.

To eliminate this false impression, ISA should make sure any comparison between Industry Funds and SMSF’s are done on a like for like basis. If a like for like basis is not available, such comparisons should not be made.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Register for my FREE Seminars and Webinars

FREE seminars and webinars with tips and strategies you can action today to get off the treadmill of working till you drop – plus time for your questions

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below