Bracket Creep – Some concerning facts about the taxes taken out of your pay packet

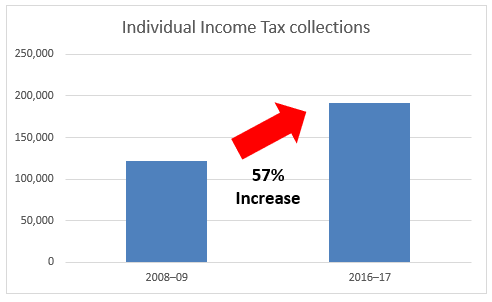

According to the taxation statistics issued by the Australian Taxation Office earlier this year, in the 2016-17 tax year, Australians paid over $192 billion dollars in tax on their personal incomes.

Here are some facts and trends about this $192 billion in tax that the politicians won’t tell you.

- This is over $70 billion more than was collected in the 2008-09 tax year. An increase of over 57 per cent in eight years. Now between June 2009 and June 2017 according to the Australian Bureau of Statistics, inflation was 19.2 per cent.

Tax collected from ordinary workers increased at three times the rate of inflation. I doubt your wages grew by three times the rate of inflation!

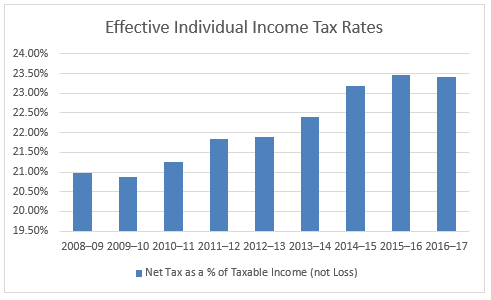

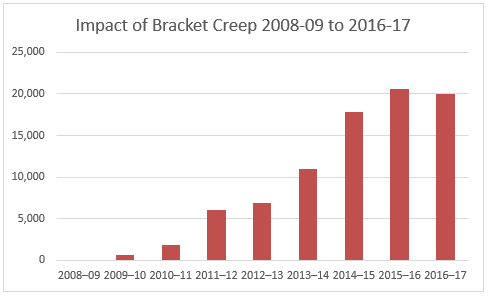

2. The average tax rate across all individual Australian taxpayers was 23.41 per cent in 2016-17. This compares with the average tax rate in 2008-09 (when the last major change in tax rates was made) of 20.97 per cent. Had we paid the same average tax rate in 2016-17 than we did in 2008-09, we would have paid nearly $20 billion less tax. This is the impact of bracket creep. If you are not sure what bracket creep is look at the example at the end of this article.

3. Since 2008-09 Australians have paid nearly an extra $85 billion in tax because of bracket creep. Across about 10 million tax payers, this averages out to about $8,500 in extra tax paid by each tax payer over the past eight years because of bracket creep.

4. When you compare what individuals pay as income tax verses companies and superannuation funds, individuals paid nearly 70 per cent of all income tax collected in the 2016-17 year. This is up from around 65 percent of all income tax in the 2008-09 year. And the major factor behind this is bracket creep.

What is Bracket Creep?

Bracket creep is where a person pays a higher rate of tax as their income increases but the tax thresholds where tax rates change do not move.

Here is an example of Fred who is on a base salary of $75,000 and how bracket creep impacts him.

In the 2014-15 year Fred got an annual bonus above his base salary of $5,000. On that $5,000 Fred paid tax and Medicare levy of $1,725. He pocketed $3,275 of the bonus or 65.5% of his gross bonus.

In the 2015-2016 year Fred’s salary did not change, but his bonus was $10,000. On this bonus, Fred now pays $3,675 in tax and Medicare levy. Out of the $10,000 bonus, Fred pockets $6,325, which is now only 63.25% of his gross bonus.

Now tax rates did not change between 2014-2015 and 2015-2016 but the effective rate of tax on Fred’s bonus went from 34.5% to 36.75%. And that is what bracket creep is.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below