It’s time to stop Compulsory Superannuation

After the Productivity Commission report, here is another damming report into the failure of the Australian compulsory Superannuation system.

This is detailed in the new book “Management and Regulation of Pension Schemes: Australia a Cautionary Tale” written by Dr Nicholas Morris.

Dr Morris is an Adjunct Professor at UNSW Law and his background includes being the Deputy Director of UK think tank the Institute for Fiscal Studies and founder CEO of London Economics. Dr Morris spent nearly six years reviewing the Australian superannuation system.

In summary, Dr Morris in this book highlights the danger to other countries wishing to adopt the Australian compulsory superannuation model. He states that doing so, would in fact impose greater risks and welfare losses on retirees, current and future.

Some of Dr Morris’s comments about the Australian superannuation system include:

- It exhibits numerous problems including that it currently delivers an income replacement rate for retirees that is amongst the lowest in the OECD.

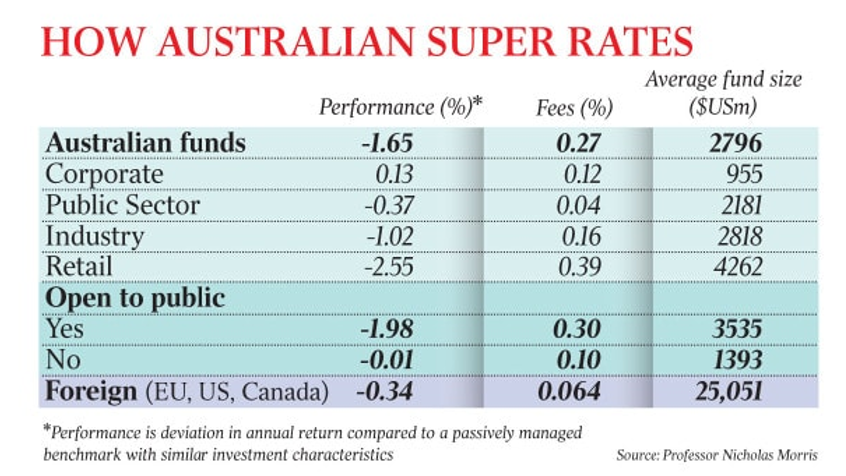

- Forces fund members to bear the risks they are ill-equipped to manage, and that it provides significantly poorer returns on investment than could reasonably been expected.

- That over the past 20 years, the returns from superannuation are $700-$900 billion less for members, than if different policy choices had been made.

- The (superannuation) industry is complex ………… (which) facilitates rent extraction. A high proportion of the potential return to investors ………. is routinely extracted by fund managers through excessive fees and charges.

- Competition and choice do not work well.

- Endemic principal-agent and conflict of interest problems remain embedded in the system.

Overall, it appears a pretty damming view on the Australian compulsory superannuation system.

And I have to say I totally agree with this view.

In my opinion, the compulsory nature of superannuation has built a bloated system of hangers on and over charging. From insurance to fees and charges and whatever else the hangers on grab. And this costs us over $30 billion per year that could be in our pocket. And Dr Morris’s research and book confirm this.

The best way to fix this would be to remove the compulsory nature of superannuation and make every superfund convince us why we should put our money into super. Much like they do in New Zealand with KiwiSaver.

This would solve a large number of problems in the super space, but this will never happen as the Government and the hangers on are too strongly tied to the rivers of cash that they get every year from it and will not give this away.

So, if the powers to be and hangers on are too tightly bound to the rivers of cash from compulsory superannuation, then we have no choice but to adopt the second best model.

And that model is to create a publicly administered fund like the Future Fund with a mandate to provide low cost, passively managed investment vehicle. And this is one of the recommendations in Dr Morris’s book.

This would now become the defacto benchmark for all other superfunds to compete against. If they can demonstrate that they outperform after fees and charges, then good on them. If they can’t, the fund members can make the choice to move.

Only then will we truly see competition and the removal of the fee gouging in the Australian superannuation system.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below