First Home Super Saver Scheme (FHSSS)– How Does it Work and Why Use it

The First Home Super Saver Scheme (FHSSS), is a scheme designed to help home buyers afford to buy first home by saving within their superfund instead of outside.

How does it Work

FHSSS is all pretty convoluted, so I will give a high level overview.

Firstly, from 1 July 2017, you need to contribute over and above what your boss contributes. This can be from salary sacrificing or from post tax money. The salary sacrificed amounts will be taxed at 15% and the post tax contributions are not taxed. Just remember:

- You can only contribute $25,000 per annum including your boss’s payments from pre-tax money.

- Maximum contributions to the FHSSS are $15,000 in any one year and $30,000 in total. Anything above that will stay in the fund and can’t be accessed

You don’t need to tell your superfund that you are doing this for the FHSSS, but check that they allow you to get access to the FHSSS funds and see if there are any implications on your insurance and what fees and charges they may charge.

From 1 July 2018, you can request a determination from the ATO for how much money will get released. Then when you are ready, you apply to the ATO for the release of the funds. But make sure you apply before you sign any contract to buy the house, and that you expect to buy the house in the next 12 months.

The ATO release gets sent to your super fund, who pay the money to the ATO and they pay you after they take out more tax. And parts of this need to appear on your tax return.

So why would you do it?

Simple, you get a tax benefit.

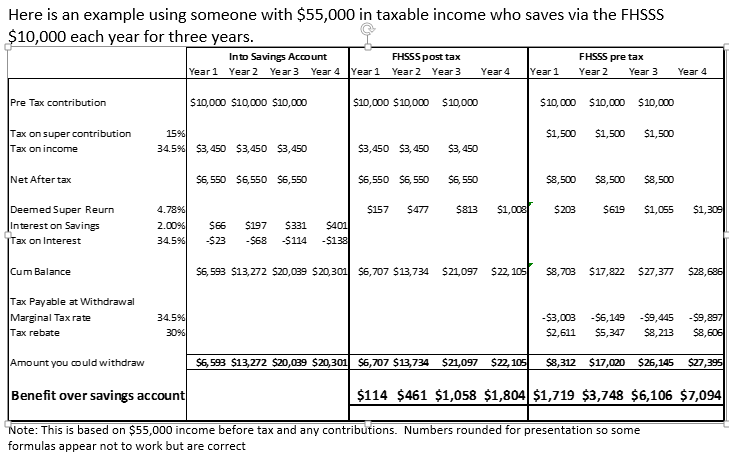

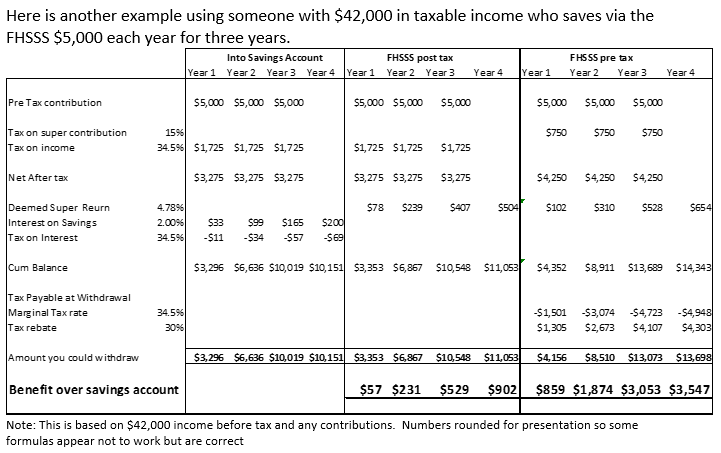

As you can see in the below examples:

- if you are earning $55,000 a year and contribute $10,000 a year for three years, you could find yourself with over $6,000 extra to help with the purchase of your first home.

- if you are earning $42,000 a year and contribute just $5,000 a year for three years, you could find yourself with over $3,000 extra to help with the purchase of your first home.

And if both partners do this, you could double your benefit.

So if you are saving for a home, the First Home Super Saver Scheme has to be one of the most tax effective ways to save at the moment.

Now if you want some help in improving the health of your wealth to have the lifestyle you want when you stop working, then why not register below for my next live event.

Register for my FREE Seminars and Webinars

FREE seminars and webinars with tips and strategies you can action today to get off the treadmill of working till you drop – plus time for your questions

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below