Using a bar tab to explain how the Australian Tax System works

Not many people understand how the Australian Tax system works and who pays for the bulk of the individual income taxes in Australia. So today I am going to use a bar tab to explain how the Australian taxation system works and what happens when there is a reduction in taxes.

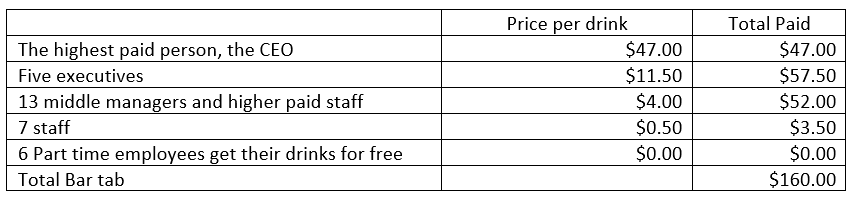

In this example, 32 people who go to a bar one Friday after work and buy a round of drinks. It is happy hour so the drinks are $5 each and the total bill comes to $160.

Now they could split the bill evenly, but they decide to split the bill the way our taxes are paid. By using the data from the 2016–17 Taxation Statistics produced by the Australian Taxation Office, here is how the bill would be split.

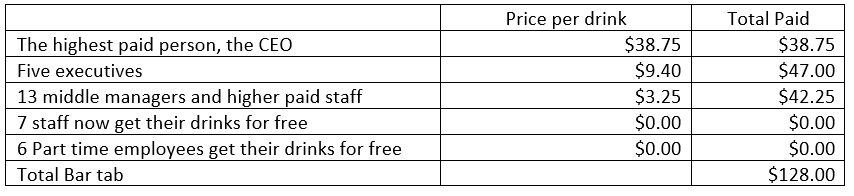

The same 32 people go to the bar one Friday afternoon and the bar has a new cheaper supplier and the drinks are no longer $5, but now only cost $4 for each drink. So now the total bar tab comes to $128.

How do they now split the bar tab? The savings are $32 and splitting this across the 26 staff who were paying the bar tab would be a saving of $1.23 each. This would mean that the 7 staff who were paying $0.50 for their drinks would now be paid to drink. This does not seem fair, so instead, they decided to split the lower tab based on how the Australian Tax system works.

The new bar tab split would look like this:

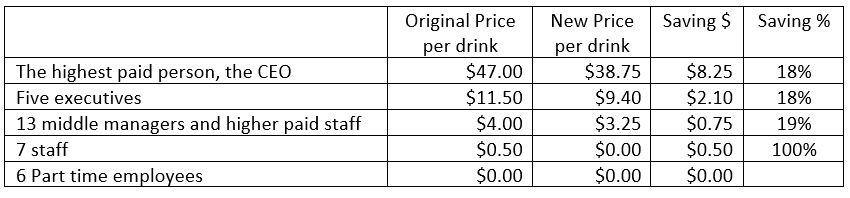

How does this impact each person?

Part time employees still get their drinks for free and now the 7 staff also get their drinks for free.

The rest of the workers save 18% each on their share of the bar tab. But as the CEO was already paying the most for the bar tab, the CEO gets the bigger dollar value reduction. And that’s why when there is a tax reduction in the Australian taxation system, the highest income earners get the biggest dollar savings.

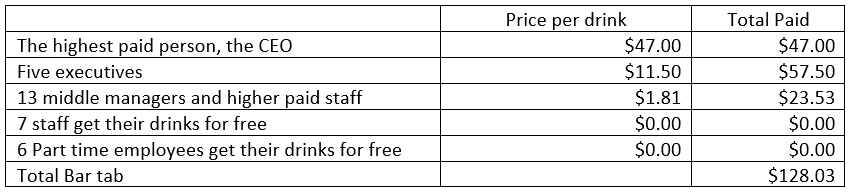

Another Option – Don’t give any benefit to the high income earners

Instead of splitting the way the Australian Taxation system works, let’s just give the savings to the people paying the least tax. In this case the bar tab would look like this:

But the problem with this is means that just 6 employees out of 32 pay for nearly 82% of all the bar tab. Should one of these chose not to turn up at the bar, the others can no longer afford their drinks.

And that’s the other side of the Australian taxation system, if you place too much burden on the top income earners, you run the risk that they don’t turn up anymore. Then everyone else has to pay more to get what they previously had.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below