Is Bill Shorten’s changes to capital gains tax just revenue raising?

Under Labor and Bill Shorten’s policies to help housing affordability, there is the policy to:

“Halve the capital gains tax discount for all assets purchased after 1 January 2020. This will reduce the capital gains tax discount from assets held longer than 12 months from 50 per cent to 25 per cent.”

I have to personally question whether the motive is to help housing affordability or whether this is just a way of raising taxes.

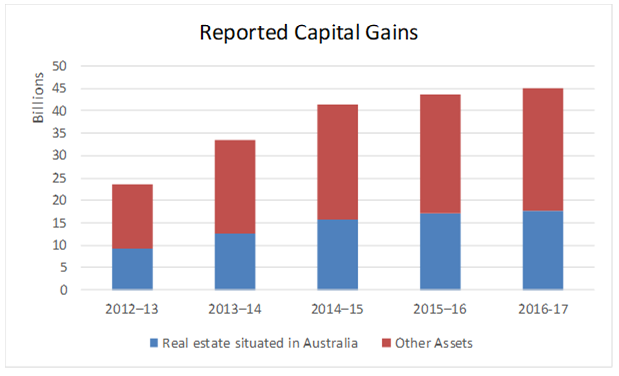

If you look at the statistics published by the Australian Taxation Office you will see that in the 2016-17 income tax year, there was $17.7 billion in capital gains relating to real estate situated in Australia.

This is less than 40% of the total $45 billion in capital gains reported by individuals in the 2016-17 income tax year.

And as you can see in the below chart covering the last five years of data from the Australian Taxation Office, capital gains from real estate situated in Australia is less than 40 per cent of the total reported capital gains by individuals.

So over 60 per cent of reported capital gains has nothing to do with real estate situated in Australia.

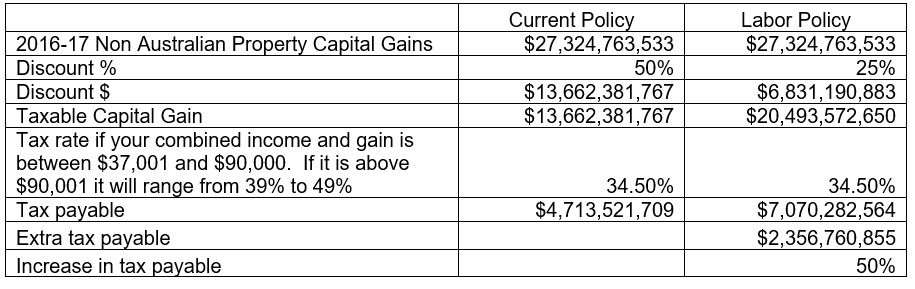

Which means share and other non-property investors are about to get a 50 per cent tax increase so that housing supposedly gets more affordable. And it is not a small increase. As you can see from the below table it could be as much as $2.4 billion.

So why aren’t the share and other non-property investors jumping up and down about a $2.4 billion per annum tax slug?

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below