Longevity Risk – One of the biggest risks you face in retirement

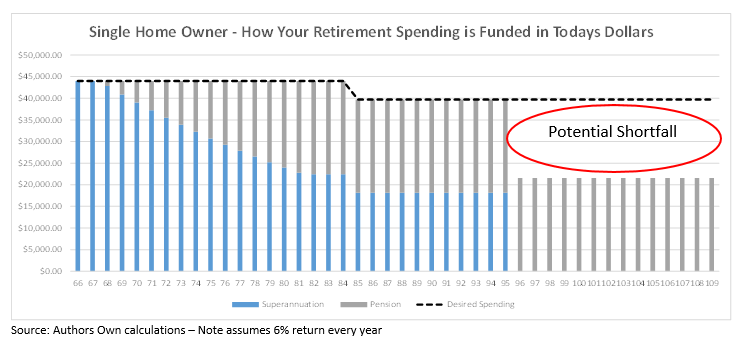

I keep reading all these articles about how much money you need in retirement. For example the Association of Superannuation Funds of Australia’s (ASFA) in its most recent Retirement Standard, states that single people will need $545,000 in retirement savings to live a comfortable life in retirement (spending $40,011 per annum in today’s dollars between 65 and 85 and $39,702 once over 85). This is assuming they own their own home.

But what ASFA don’t tell you is how long does this money last compared to how long you actually live. This is what the industry calls longevity risk.

Using ASFA’s returns of 6 per cent for every year, I have calculated that this money will last till you are about 95. Thereafter you are left living on the pension and have less money than is required for what ASFA calls a comfortable living.

Now 95 seems a nice old age.

But what if you are one of those people who live to 100. Today there are now over 4,000 people, 100 or older in Australia (about 3,000 are women). This is up over 20 times from the 203 in 1971, when our population has not quite doubled in that time.

And what is life expectancy currently looking like? From what I can see, if you were a 60 year woman, there is:

- a 20 per cent chance that you will live to 95.

- a 4 per cent chance you will live to 100.

So if you are in the 80 per cent of women who don’t survive till 95, then the $545,000 will last and you will have a comfortable retirement according to ASFA. But if you are in the 20 per cent who live longer, then your longevity risk means that unless you are willing to live on the pension you need more.

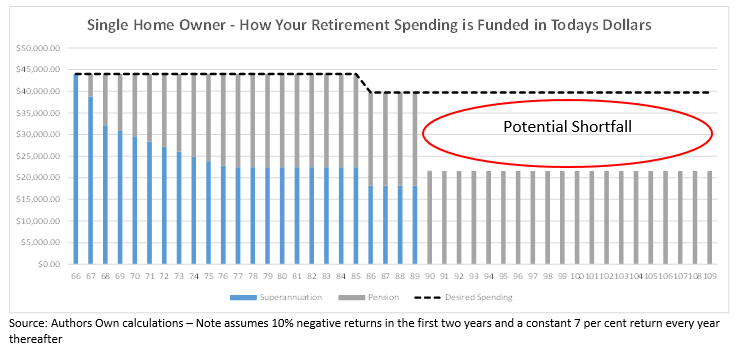

Now what about sequencing risk?

Now sequencing risk is the where the returns are not even. You may average per year 6 per cent returns, but what happens, if instead, you are about to retire in a year where there is a major stock market crash, which history shows does occur. For example because of another stock market crash, your returns are negative 10 per cent for the first two years and positive 7 per cent thereafter.

This will significantly impact on how long your money lasts. As you can see in the below chart, I estimate that your $545,000 which was going to last till you were 95, now only lasts till you are 89.

So if you were a woman aged 65 today, there is a 48 per cent chance you will live beyond 89. In other words, there is a 1 in 2 chance that if you retired at a time when the markets were falling, then $545,000 will not be enough unless you are willing to live on the pension in your later years.

The Morale of this Post

If someone tells you a number you need your retirement funds to be, don’t blindly accept it.

You need to understand:

- what life expectancy they are using (your longevity risk); and,

- whether they have factored in any risk of low or negative returns, especially in the early years (your sequencing risk).

Only then can you really make an assessment of the number they have told you and what it could really mean for you.

Now if you want some help in improving the health of your wealth to have the lifestyle you want when you stop working, then why not register below for my next live event.

Register for my FREE Seminars and Webinars

FREE seminars and webinars with tips and strategies you can action today to get off the treadmill of working till you drop – plus time for your questions

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below