What do you need for a comfortable retirement?

According to the ASFA September 2017 Retirement Standard, a couple need an after tax income of $60,457 each year to have a comfortable retirement.

Scott Pape, The Barefoot Investor was in the paper over the weekend stating that for a couple “you need a paid-off home, plus $250,000 in super” for this comfortable retirement.

In my view, that’s not a plan for a comfortable retirement, it’s a plan to work till you drop.

Let me explain why.

After getting the pension of $34,819 per annum and $12,500 from a 5% return on your $250,000 super, Mr Pape says you only need to find another $13,138.

And here is the first kicker of Mr Pape’s retirement plan. He states in his article that “the golden rule of retirement is … keep working” and “never, ever retire”.

So Mr Pape’s retirement plan for you is to have a paid-off home, $250,000 in super and don’t retire. That’s right, keep on working. Not sure how retirement and keep on working go together.

And that sad bit about his “retirement” plan is that you have to keep on working till you drop!

That’s right at no stage can you stop working and live ASFA’s standard of a comfortable life on the pension and $250,000 of super.

Don’t believe me, let’s take the example of Mary and Jake

They retire at 67 with their house paid off and $250,000 in super between them. For this exercise we will assume that Mary and Jake have a crystal ball and know that Mary will live till 88 and Jake to 85. So they plan to not only take the income from their super each year ($12,500), but draw down on their super balance so that when they die they have no super left. In this situation, this actually gives them more money than Mr Pape does.

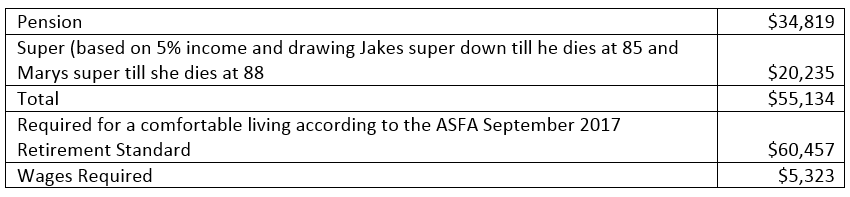

So their cash looks like this in year 1:

At $25 dollars an hour, Jake and Mary need to work a combined 4 hours a week on average over the year.

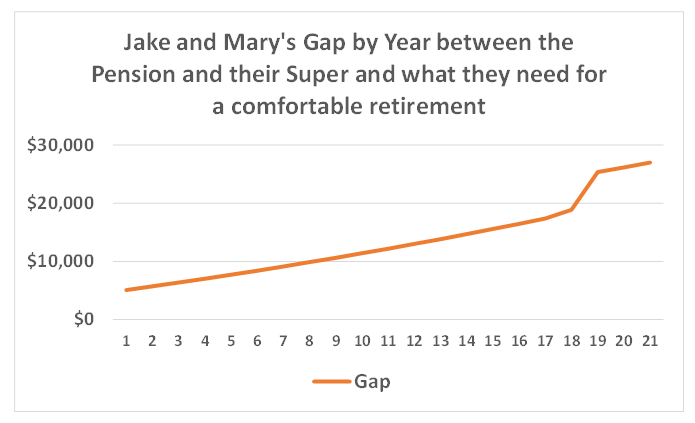

Well, a gap of $5,323 and having to work 4 hours a week is not much. But that’s just the first year. Let’s have a look at the later years and have a look at the gap between what the pension and their super will give them against what is estimated they need for a comfortable retirement in future years.

Putting it in words, if Jake and Mary want what ASFA considers a comfortable retirement, on Mr Pape’s retirement plan:

- After 10 years, Jake and Mary will need to work on average, 7 hours a week when they are 77.

- After 15 years, Jake and Mary will still be working an average of 8 hours a week when they are 82.

- And after Jakes death, poor Mary needs to work 13 hours a week on average when she is 87!

On my calculations,

if Jake and Mary live to 85 and 88 respectively, they would need about $430,000 in super to live a comfortable life as defined by the ASFA Retirement Standard, without having to work.

But what if they actually lived to 95?

Based on my calculations, they would need about $800,000 in super.

And that’s why I say Mr Pape’s plan for a comfortable retirement of a paid-off home, plus $250,000 in super, is not a retirement plan. It’s really a plan to work till you drop.

Want to work out your plan for a comfortable retirement, why not register for one of my free seminars or webinars below.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Register for my FREE Seminars and Webinars

FREE seminars and webinars with tips and strategies you can action today to get off the treadmill of working till you drop – plus time for your questions

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below