The Pros and Cons of a Self-Managed Super Fund (SMSF)

Introduction

Many people have heard of the term self-managed super fund (SMSF) but don’t really understand how they work and whether they should be consider setting up their own self-managed super fund.

So in this blog, you will learn a bit more about how SMSF’s work, and the pro and cons of having your own self-managed super fund.

Now I want to stress that this is general information. It is aimed at educating you about SMSF’s. I can’t tell you whether a SMSF is appropriate for you in your situation, but by understanding more about SMSF’s, you can ask the right people the right questions, and work out if a SMSF is for you.

What is a Self-Managed Super Fund?

As most people are aware, today, employers must pay superannuation for most employees to an approved superannuation fund.

This approved superannuation fund can be managed by third parties (such as a bank and its retail super fund, or by an industry super fund), or can be managed by yourself. To manage your super yourself, you set up a self-managed super fund (SMSF) in accordance with applicable rules and legislation.

The key structure / rules of a SMSF:

- Effectively a SMSF is a special purpose trust set up under the Superannuation Industry (Supervision) Act 1993 (“SIS Act”).

- SMSF’s are effectively monitored by the Australian Taxation Office (“ATO”).

- A SMSF can only have between 1 and 4 members.

- The members of the SMSF do not need to be related, and one person can be a member of multiple SMSF’s (but be careful if you do this as the ATO is watching to make sure you are not doing this to defeat the new rules around maximum amounts in tax free pension mode).

- The SMSF itself can have any name you like, and can be the same as someone else’s SMSF.

- All assets of the SMSF are held in trust on behalf of the members. This requires a trust deed which complies with all the applicable rules and legislation.

- The trustees of the SMSF can either be individuals or a corporate trustee (see below for more details on this)..

- A SMSF can only have the sole purpose of providing retirement benefits for the members or their dependants. A SMSF can’t own the house you or your family live in. A SMSF can’t own a holiday house you use. A SMSF is limited in purchasing other assets such as artworks you decorate your home with. There is also a fine line between a SMSF owning a business and actually running a business.

- You can’t use a SMSF to get early access to your super.

Corporate v’s Individual Trustee?

If it is individual trustee, apart from a single person SMSF, all trustees must be members and all members must be trustees. A single member fund, can have 2 trustees, the member and one other.

A corporate trustee just means that you have a non trading company acting as trustee. Apart from a single person SMSF, all directors of the trustee company must be members and all members must be directors. Single member funds can have 2 directors of the trustee company, the member and one other..

So if the SMSF has a corporate trustee, the owner of the actual asset / investment would be something like Corporate Trustee Pty Ltd as trustee for (ATF) Blogs Family Superfund. If the SMSF has individual trustees, owner of the actual asset / investment would be something like Billy Blogs ATF Blogs Family Superfund. Note the name of the corporate trustee will be unique as this is controlled by the Australian Securities and Investments Commission (“ASIC”).

I personally have a corporate trustee. The benefit of this is that you can easily add other members (up to the limit of 4) just by updating ASIC records. You do not need to change any investment ownership records, as the Corporate Trustee itself has not changed. This also works in reverse if a member leaves or dies, just update ASIC.

Just imagine in the previous example if all assets where registered in the name of Billy Blogs ATF Blogs Family Superfund and Billy Blogs died. You would have the hassle of changing all of these. If the assets where in the name of Corporate Trustee Pty Ltd ATF Blogs Family Superfund, on Billy’s death, the remaining trustees do not need to do anything in respect of the ownership of the SMSF assets – so much simpler.

How many SMSF’s are there?

In terms of number of approved superannuation funds, SMSF’s make up over 99% of the industry. There are about 600,000 approved self-manged super fund.

SMSF’s make up about 30% of the total amount of superannuation in Australia. This is the fastest growing sector of the superannuation industry and is up from 10% of the industry in 1998. SMSF’s have currently about $700 billion dollars in assets.

So in terms of numbers and money, SMSF’s make up the largest and fastest segment of the superannuation industry in Australia.

So why are they so popular?

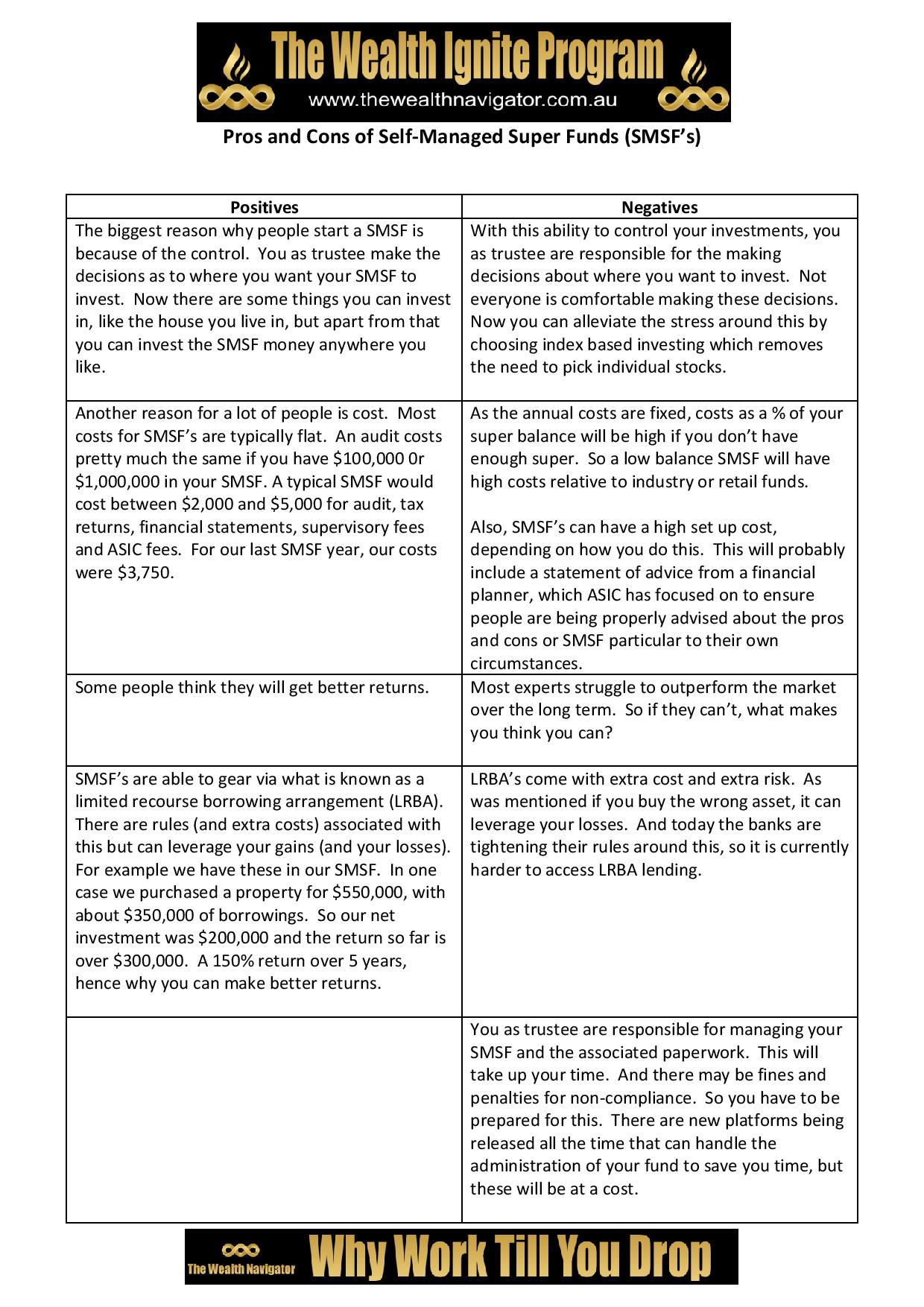

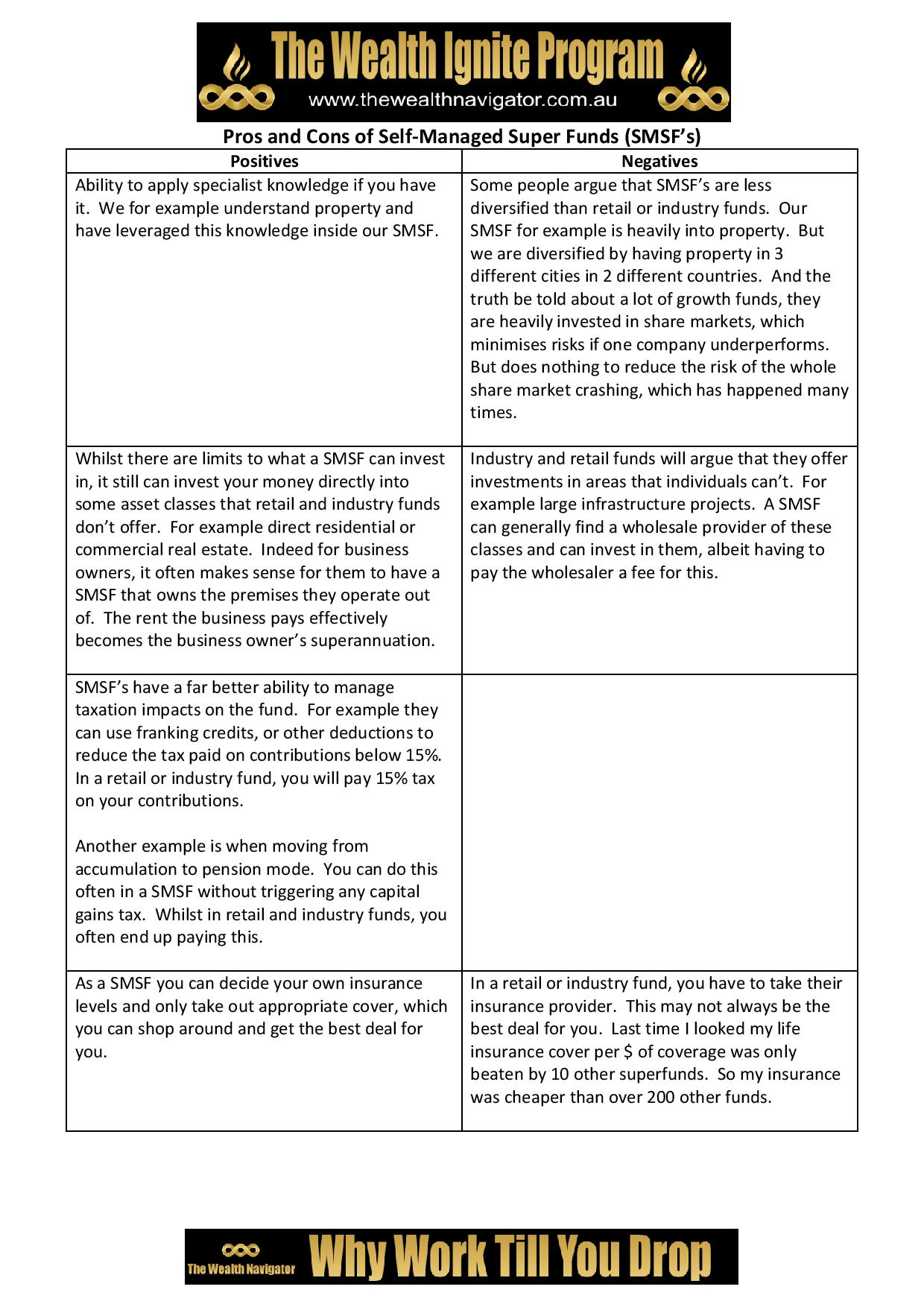

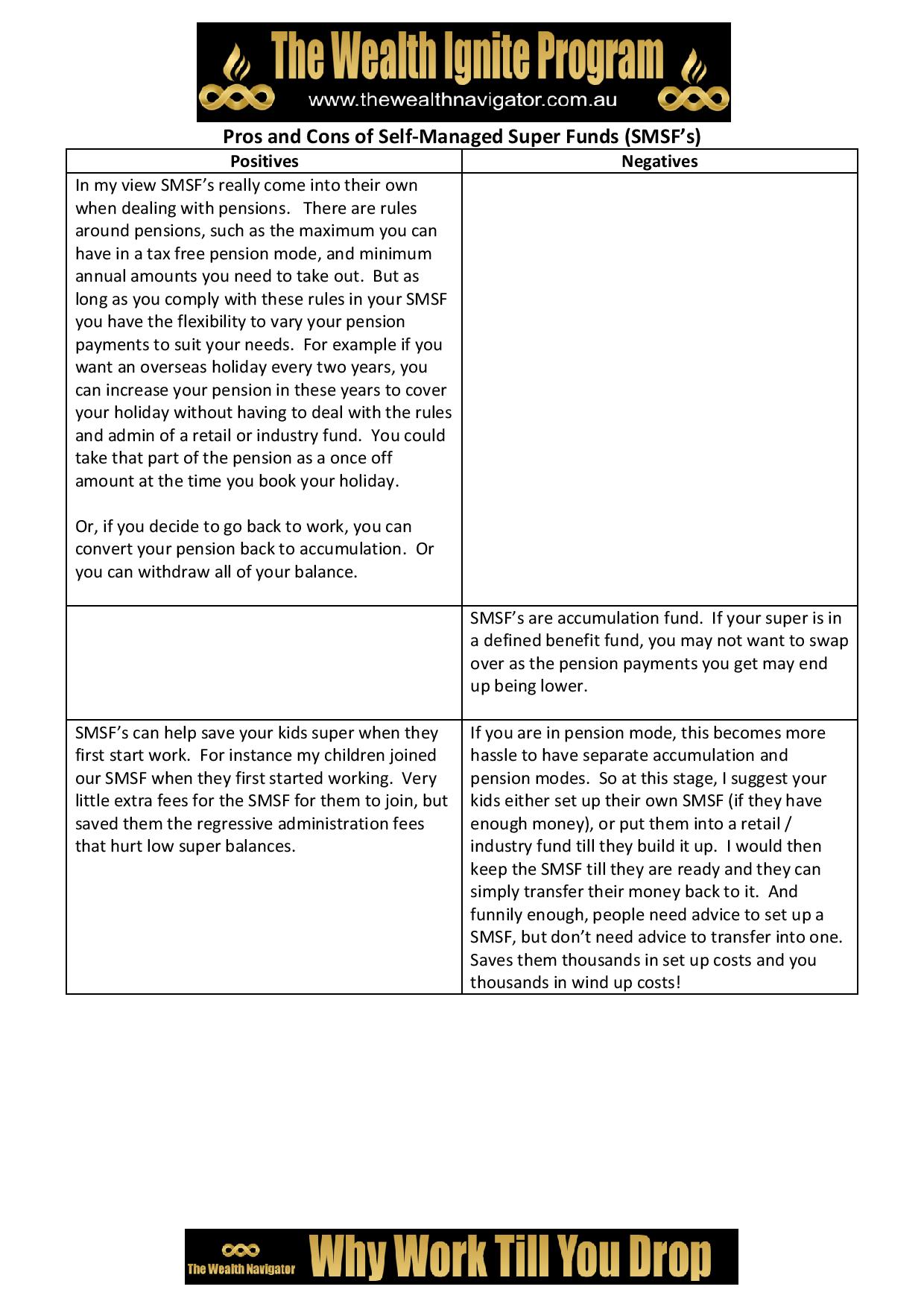

The Pro’s and Con’s of a Self-Managed Super Fund

Your Choice?

I know for me and my family the positives outweigh the negatives and we have had a SMSF for over 15 years. So we are not recent converts.

But, I am an accountant by trade, I can manage the SMSF’s books and I understand legal bumf that often applies to a SMSF. Many a time I have had discussions with so called experts about errors they are making.

For You? I don’t know you and can’t tell you what you should do. For starters I would go through the above list and if you think the positive outweighs the negative then mark that point with a 1. If the negative outweighs the positive then mark that point with a minus 1.

Add up your score. If it is negative, a SMSF is probably not for you.

If it is positive, and you have enough super to make it economic, then it may be worthwhile you start investigating a self-managed super fund..

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Register for my FREE Seminars and Webinars

FREE seminars and webinars with tips and strategies you can action today to get off the treadmill of working till you drop – plus time for your questions

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below