Are you suffering from Lifestyle Inflation?

Every six or so years, the Australian Bureau of Statistics (ABS) does a survey of household expenditure. The last survey released late in 2017 shows that the average Australian is still suffering from lifestyle inflation.

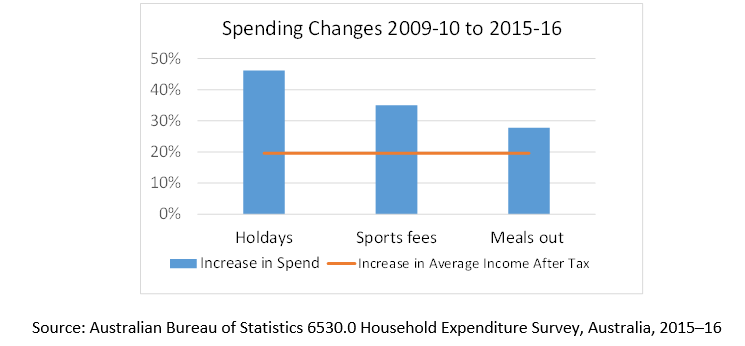

Between 2009-10 and 2015-16 when the last two surveys were done, the average monthly household income after tax in Australia rose by 20% from $1,426 per month to $1,706 per month.

But when you look at the detail of where Australian’s spend their money, you see that we are spending more and more on money on our lifestyle.

As you can see from the above chart, the average monthly spend on:

- holidays is up 46%;

- meals out and fast foods is up 28%; and

- sports fees and charges is up 35%;

So the average Australian is spending more and more of their after tax money on their current lifestyle. What I call lifestyle inflation.

And this lifestyle inflation will mean that most Australians will remain on the treadmill to work till they drop.

If you want to get off the treadmill of working till you drop, you need to beat this lifestyle inflation habit.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Register for my FREE Seminars and Webinars

FREE seminars and webinars with tips and strategies you can action today to beat lifestyle inflation and get off the treadmill of working till you drop

Do you and your family a favour and start taking steps so you can beat lifestyle inflation and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below