Who really wins if the $450 monthly earnings threshold for superannuation is removed?

Parts of this post have been reported in Money Management. Click here to see the Money Management Article or on the Money Management logo below.

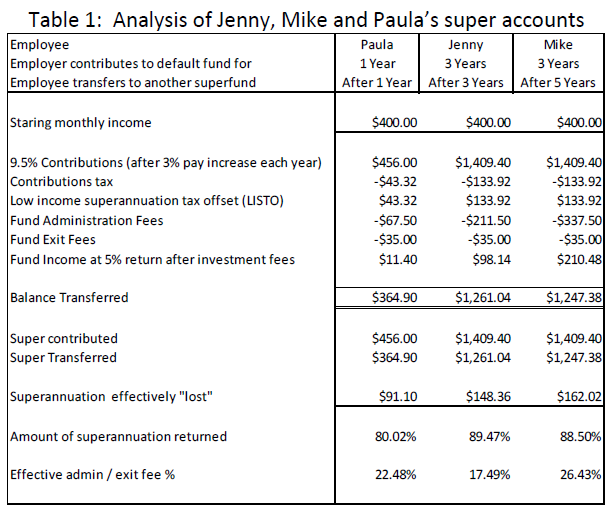

My analysis shows that unless regressive fees charged by superannuation funds like administration and exit fees are removed, it will be the superfund, not the low income earner who wins.

There has been a lot of talk lately about removing the $450 minimum monthly earnings threshold for superannuation. Fundamentally, there are a lot of reasons why it makes sense to remove this threshold and have all employees get paid superannuation irrespective of what they earn.

But this change has to be made properly, or the only real winners from this change will be the superannuation funds themselves.

Why?

Because most superannuation funds, whether they are retail or industry funds, charge regressive administration and exit fees. Because these fees are the same whether you have $500 or $50,000 in superannuation, they are regressive. And what’s worse, these regressive fees eat away quickly at the superannuation balances of low income earners.

Let’s Look at what happens to 3 different people

Don’t believe me, then let’s look at three people who are just about to start working part time at a local pool teaching people to swim. We have Mike and Jenny, both 18 and just about to start their first year of university and want some party money, and Paula, a 35 year mother, wanting some part time work whilst her kids are at school.

For the sake of this analysis, let’s assume they start on 1 July and each get paid the same $400 per month. Under the current super rules, their employer does not need to pay super, but being a good corporate citizen, the employer decides to pay super on top of the $400 each earns per month. Their employer pays the super on the due date each quarter and gives them a 3 per cent pay rise each year.

Now, not thinking about their super, all three just have their super put in their employers default fund, which has consistently returned 5 per cent, per annum. This fund charges what seems to be a nominal weekly administration fee of $1.50 and a $35 exit fee.

Roll forward 12 months and the super statements arrive. Paula realises her mistake of creating a new account and transfers the balance to her previous fund. Jenny and Mike have no other funds, so they don’t change.

Two years later, Jenny and Mike start full time jobs and Jenny transfers her super to her new employer’s fund, but Mike does not do this for 2 more years.

So what happened to their super?

Notwithstanding the superfund reported a 5 per cent investment return, Jenny, Mike and Paula all lost money. That’s right, their super went backwards.

For every dollar that their employer contributed to super, Jenny, Mike and Paula got less than 90 cents back! And it was not the government, who refunded the tax via the low income superannuation tax offset (LISTO).

It was because, in each instance, the superfund pocketed more in administration and exit fees, than was credited in fund income.

So a real killer for people with low superannuation balances is the regressive nature of fixed account fees such as administration fee and exit fees that most funds charge. In the case of Jenny, Mike and Paula, the effective rate of these fees was in excess of 17% of the funds contributed.

There is no way to describe this other than highway robbery. And it applies equally across industry and retail superfunds.

So if we really have low income earners superannuation balances at heart, not only should we remove the $450 monthly earnings threshold for superannuation on, but we should also remove the regressive fees such as administration and exit fees, charged by retail and industry super funds alike.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Register for my FREE Seminars and Webinars

FREE seminars and webinars with tips and strategies you can action today to get off the treadmill of working till you drop – plus time for your questions

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below