Why the ISA’s unpaid super scandal is Fake News

Industry Super Australia (ISA) released a report on 3 May 2019 about the “great unpaid super scandal” in which they claim that one in three workers are underpaid $5.94 billion in superannuation in a case of exploitation by bosses.

As someone who has reconciled and made payments of superannuation for many businesses for over 20 years, I don’t believe that one in three workers are underpaid $5.94 billion in superannuation.

I believe that the ISA’s “great unpaid super scandal” analysis has not made full allowance for the rather complicated nature of superannuation legislation. In particular there are a number of valid and entirely legal reasons why there can be a difference between someone’s salary in their tax return and the super paid by their employer(s) over the same period.

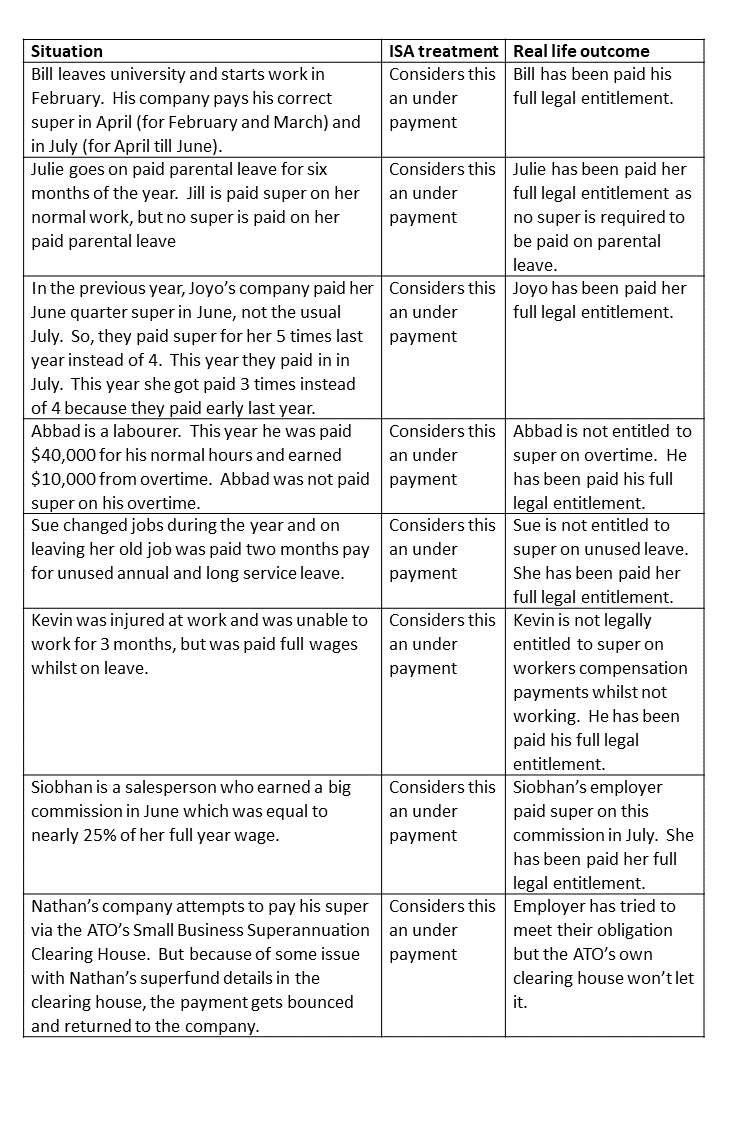

Some of the typical examples I see include:

I doubt that ISA’s “great unpaid super scandal” analysis has properly allowed for these, and other totally legal reasons why there will be a difference between someone’s salary in their tax return and the super paid by their employer(s) over the same period. Hence why I don’t believe that one in three workers are underpaid $5.94 billion in superannuation.

There will be some underpayments

Now don’t get me wrong, there will be some people underpaid superannuation.

The ISA in its analysis implies that all unpaid super is from exploitation by bosses. Yes, there will be some of this. For example, I have personally worked in a business in trouble that did not pay its super obligations before it collapses. Was it exploitation? Not sure?

But my experience is that the typical reason for underpayment is because of the complexity of the superannuation legislation. As you can see above there are a number of carve outs that mean that superannuation is not payable on some payments made to employees. But what confuses this even more is that some carve outs apply to some employees and not others even in the same business. Overtime is a case in point. Some employees are entitled to super on their overtime and others are not.

I sometimes have trouble confirming what payments should get superannuation paid, and I have been doing this for over 20 years.

What to do about it?

And that’s why I say it’s time to remove some of the complexity around the calculation of superannuation guarantee contributions. It would be far simpler that any payment made to the employee which is subject to pay as you go income tax (their gross pay for that pay period) is included in the calculation to determine how much superannuation guarantee contributions are to be made. Irrespective of how the employee earned it. And there is no minimum threshold.

This would make it simpler for employers as there is no need to double check how each payment is classified. They could also double check their superannuation obligations quickly by ensuring it is 9.5 per cent of gross payroll payments.

And it is simpler for employees. The superannuation on their pay slip should just be 9.5 per cent of their gross pay. If not – they know the employer has made a mistake and they can challenge this.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.

Do you and your family a favour and start taking steps so you can improve the health of Your Wealth and get off the treadmill of working till you drop.

Wayne Wanders

The Wealth Navigator

wayne@thewealthnavigator.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below