Handy Tips to Help You Improve the Health of Your Wealth so You Can Get Off the Treadmill of Working Till You Drop

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.

New Year’s Resolutions – Make yours about your own financial future

Watch this video to understand why I believe you are probably on the treadmill to work till you drop.

And to get off this treadmill, you need take responsibility for your own future. And there is no better time than today to start taking responsibility. Why not make your New Year’s resolution to accept responsibility for your own financial future and take action now to improve the health of your wealth so you can get off the treadmill of working till you drop.

Why you need to make a New Year’s resolution about your financial future

As we move into the New Year, you have a choice about your financial future. Do nothing different. Stay on the treadmill. Face the prospect of delaying your retirement and working till you drop. Or make a make a New Year’s resolution to take responsibility for your own financial future. Improve the health of your wealth, so you can get off the treadmill of working till you drop

Ageing and Labour Supply in Advanced Economies

Just before Christmas, the Reserve Bank of Australia (RBA) released a bulletin titled “Ageing and Labour Supply in Advanced Economies”. This bulletin looks at what is happening in the labour force as a result of the ageing of the population and shows why you need to take responsibility for your own financial future now

Why maybe this is the week to start using cash instead of your credit card

if you want to avoid the credit card hangover in the New Year, maybe this is the week to start using cash instead of your credit card

Are you expecting to have a great life on the pension when you stop working?

According to the OECD, when you stop working, the pension in Australia will give you a lower standard of living than the average across all OECD countries.

Solving the Problem of time and earn more money

To grow your income these days, you need to add more value or solve bigger problems. And when I say this to people, they often say they don’t know how. Read this to learn how a flying instructor can solve the problem of time for herself and her students and potentially increase her income by over 60%. Without working any more hours, and not by charging more!

Buy Nothing Day

Here is a video I did a while ago to show you how to go on a spending diet. Why not use today being Buy Nothing Day to be the 1st day of your spending diet

Want to increase your pay – Why You Need More than a University Degree

If you want to increase your pay, just having a university degree is no longer enough. You need to set yourself apart and one way to do this is by improving your transferable skills. Watch the video to learn more

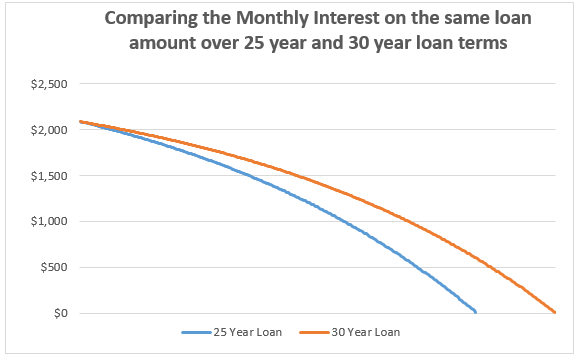

Are banks doing you a favour with 30 year loan terms?

Today we are seeing more and more people sign up for 30 year loan terms instead of 25 year loan terms. Are they better or worse for you?

Industry Insider lifts the lid on Super – Not Fit for Purpose in Retirement

Finally someone in the industry owns up about what I have known for ages. For most people, super is Not Fit for Purpose in Retirement

National Financial Literacy Strategy Consultation 2017

As someone interested in improving Financial Literacy in Australia, I made a submission to ASIC in respect of their National Financial Literacy Strategy Consultation 2017. Click here to learn more

Rentvesting – What is it and is it right for you?

Read this to learn why rentvesting is not a valid long term wealth strategy for most people and to see if you are one of the exceptions

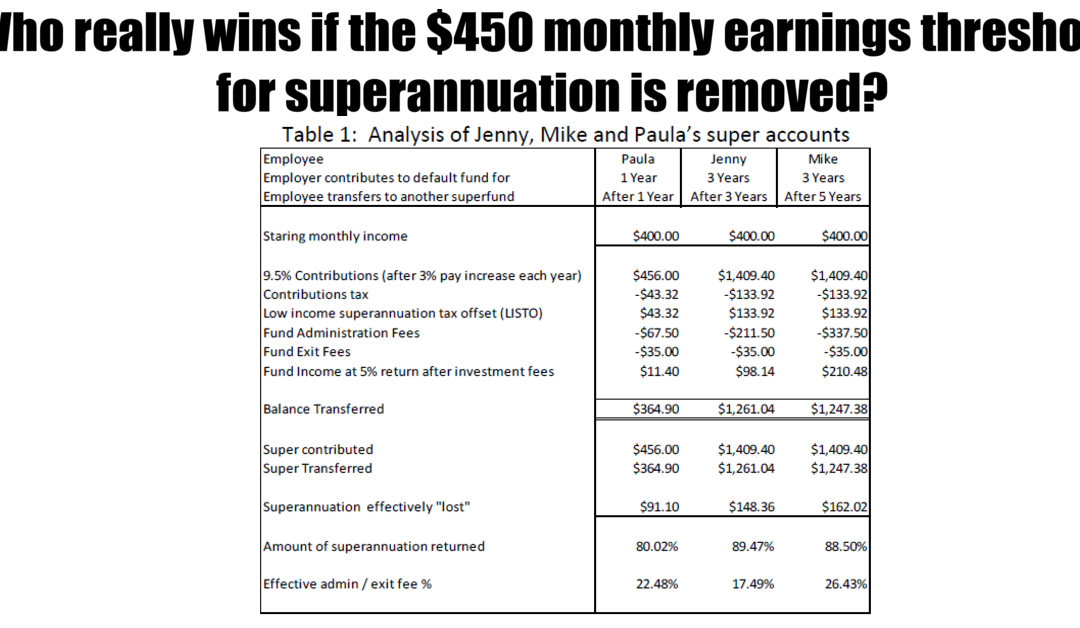

Who really wins if the $450 monthly earnings threshold for superannuation is removed?

My analysis shows that unless regressive fees charged by superannuation funds like administration and exit fees are removed, it will be the superfund, not the low income earner who wins. Read on to learn why

Is Your House and Asset or a Liability

Is your house an asset or not? Here is Robert Kiyosaki’s views on this. And for lot of people I have to agree with him. Where are you sitting?

Regional Australia and Housing Affordability

About time someone woke up and looked outside Sydney and Melbourne housing affordability to see what the rest of Australia’s property market was doing.

Super stuffed: How the pay gap is really limiting your future

This is an article women need to read. It shows why women’s super is stuffed as they generally have half the super of men to last twice as long

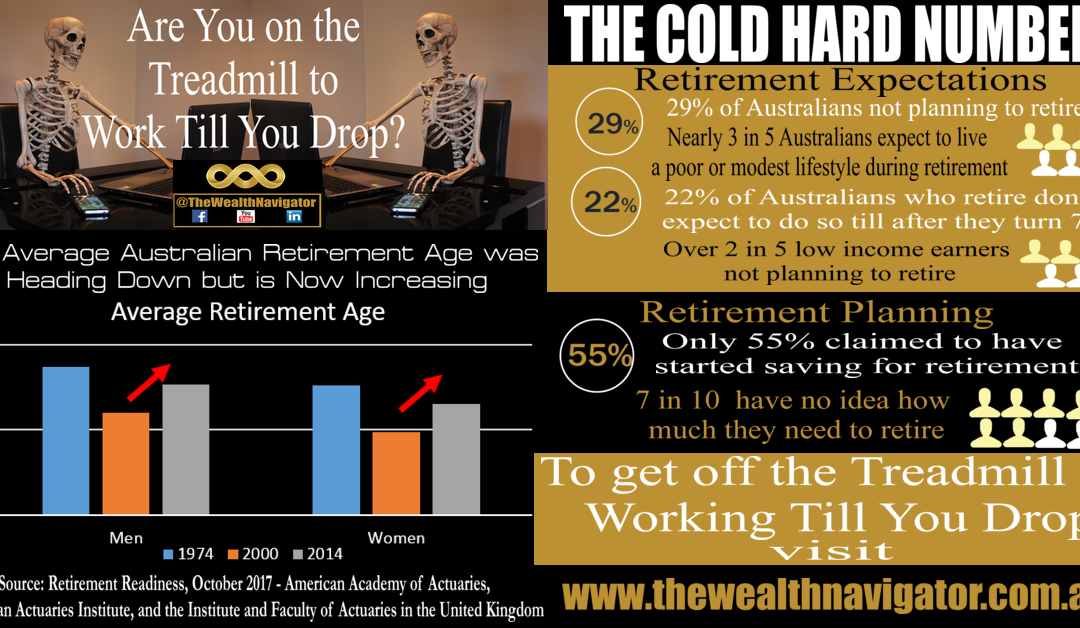

Despite 25 years of Compulsory Superannuation in Australia, most people remain on the Treadmill to Work Till They Drop

LinkedIn facebook Twitter Despite 25 years of Compulsory Superannuation in Australia, most people remain on the Treadmill to Work Till They Drop The Retirement Readiness Report, by the American Academy of Actuaries, the Australian Actuaries Institute, and the...

Sydney First Home Buyer Housing Affordability – A Comparison Between 1989 and Today

Read this to see why purchasing a first home in Sydney today is less affordable than it was in 1989, a period you could previously argue was one of the least affordable times to buy such a home in Sydney.

Is your House your Biggest asset or your Biggest Liability?

I want to ask you, is your house an asset or a liability? To most people they see it as their biggest single asset.

But, in reality, for a lot of people I see it is actually their biggest liability. Learn why I believe this here.

Video of the Week – Know your worth, and then ask for it

Watch this video to learn how you can realise your full earning potential. In other words, know your worth, and ask for it.

Wayne Wanders, The Wealth Navigator Has Been Published in

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.