Handy Tips to Help You Improve the Health of Your Wealth so You Can Get Off the Treadmill of Working Till You Drop

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.

#MeTooForTheMoney

After spending several weeks to research and write my new report, “How to Beat the Gender Wealth Gap”, I have realised it’s time to launch the #MeTooForTheMoney campaign to stop the women of Australia financially suffering from not being treated equally at work.

False and Misleading Information from Industry Super Australia

Early this week, Industry Super Australia released a briefing note, titled “ATO Self-Managed Superannuation Funds – A Statistical Overview 2015-2016”. I strongly believe that this is false and misleading reporting. Read this to learn why and see where my comments have been reported in the media.

What pain is in your financial future?

What pain is in your financial future? Will you go through the pain of change, or do nothing and suffer the pain of regret?

How Can an Olympic Athlete Help You Earn More Money?

With the Winter Olympics on, I thought I would share a video I recorded at Sydney Olympic Park back when the 2016 Rio Summer Olympic Games were on. But the message of how an Olympic Athlete can help you earn more money is still the same.

Today is a Big Day

Not only is today 16 February 2018, the Chinese New Year, but it is also Tim Tam Day and Innovation Day

So have a Tim Tam whilst celebrating Chinese New Year and think about what innovation you can do to improve your life, your families life or the world in general

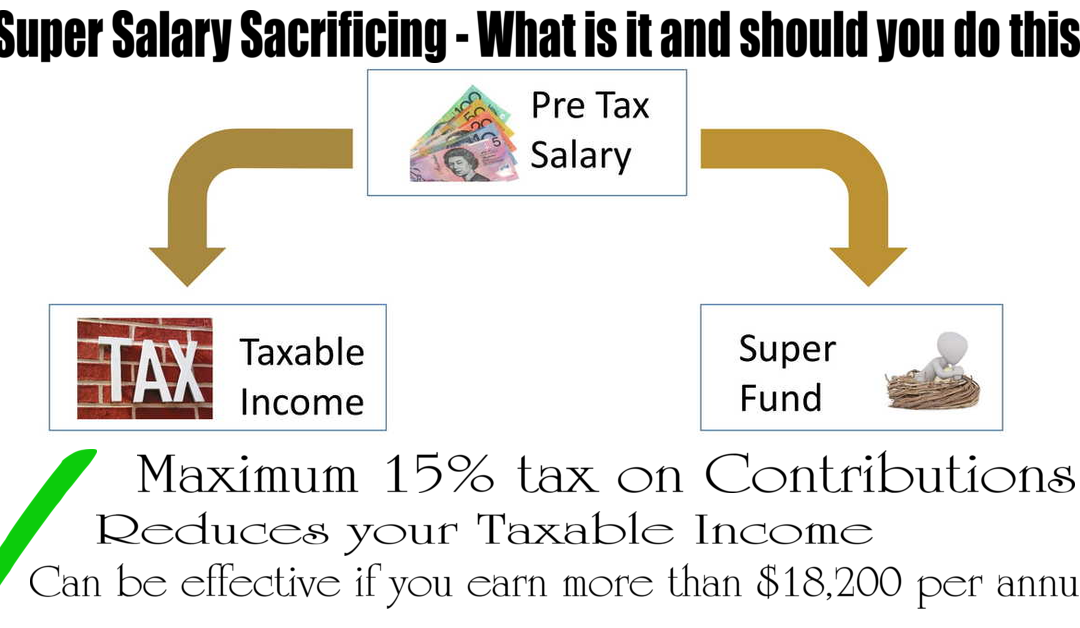

Super Salary Sacrificing – What is it and should you do this

Don’t do Super Salary Sacrificing because you are scared the Boss will pocket the money? Well read this to learn the new rules around Super Salary Sacrificing and why you may benefit from sacrificing some of your money into super.

What’s the best way to close the gender gap in retirement incomes

Read why I believe that the latest proposals contained in Grattan Institute’s paper What’s the best way to close the gender gap in retirement incomes will actually hurt more women than it helps.

Video of the Week – Believe in Yourself

From the mouth of children. Watch this funny but highly motivational video and Believe in Yourself. Totally apt on #LaughandGetRichDay

4 Reasons You Should Think Like an Ant

I came across this Jim Rohn post “4 Reasons You Should Think Like an Ant “again the other day and I thought i would share it. We don’t have winters like the east coast of the US but the message is still the same

Are you suffering from Lifestyle Inflation?

Every six or so years, the Australian Bureau of Statistics (ABS) does a survey of household expenditure. The last survey released late in 2017 shows that the average Australian is still suffering from lifestyle inflation. Are you one of them? Read on to learn more.

The Pros and Cons of a Self-Managed Super Fund (SMSF)

Many people have heard of the term self-managed super fund (SMSF) but don’t really understand how they work and whether they should be consider setting up their own SMSF. Read this and learn a bit more about how SMSF’s work, and the pro and cons of having your own SMSF.

What do you need for a comfortable retirement?

According to the ASFA September 2017 Retirement Standard, a couple need an after tax income of $60,457 each year to have a comfortable retirement. So how much super do you need for a comfortable retirement?

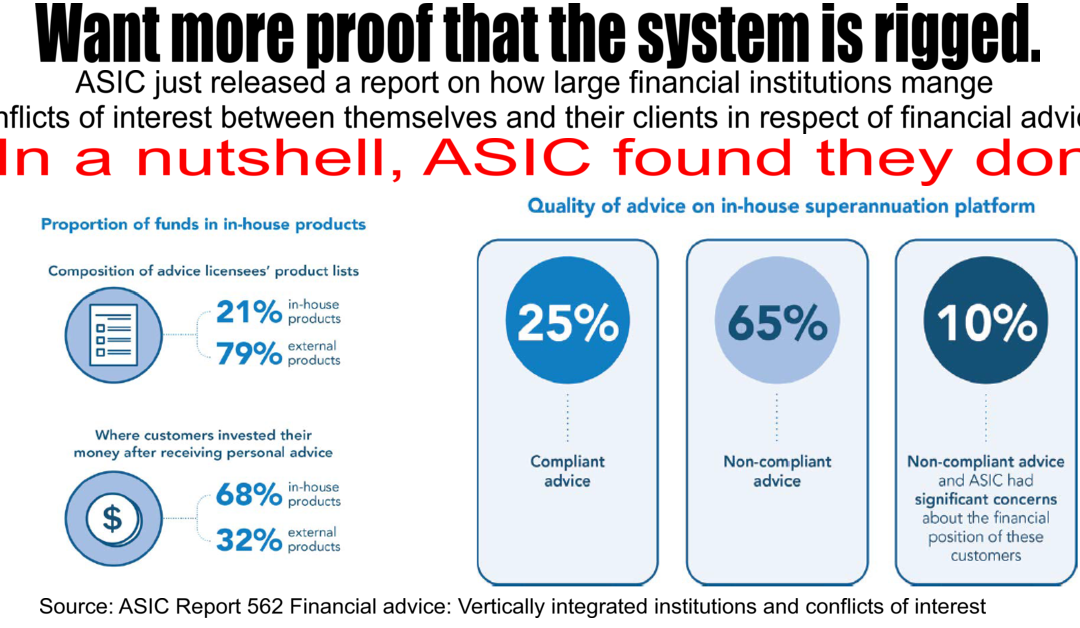

Most Big Bank financial planners fail to act in your best interests

Want more proof that the system is rigged. ASIC just released a report on how most Big Bank financial planners fail to act in your best interests. Read the findings here.

How to Avoid the Christmas Hangover in 2018

Did your Christmas Cheer turn into Christmas Jeer when you saw your credit card or bank statement this month and thought “How am I going to afford it”?

Well, if you want to avoid the New Year’s credit card hangover, then maybe it is time to take one simple set and forget solution now so you can avoid the Christmas Hangover in 2018.

How to Focus Your Resources on Achieving Your Goals

Great article about how to link your goals with what you want to do in life so you can Focus Your Resources on Achieving Your Goals

2018-19 Pre Budget Submission

Rather than sitting back and whinging about various issues affecting the retirement outcomes of hard working ordinary Australians, I decided this year to make a formal pre budget submission

Ditch New Year’s Resolution Day

If you want to get past “Ditch New Year’s Resolution Day” and be the 1 in 10 who actually achieve their New Year’s resolution to have more money, or the 1 in 100 who actually achieve financial freedom. Then this FREE event in Sydney CBD 6.30pm Monday 22 January 2018 may be for you.

The $450 Superannuation Guarantee Threshold

Here is the Government’s Views on why the $450 Superannuation Guarantee Threshold will not be removed and what we need to do if we want to remove this

Pensions – Are we Testing the Right Means?

We have a means test that rewards spending, not saving. It is time to start to have a system that focuses on getting people to save for their own retirement

When is the last time you looked for money leaks?

Given that it is pretty easy these days to put things on the debit or credit card, how much money are you losing from money leaks?

Wayne Wanders, The Wealth Navigator Has Been Published in

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.