Handy Tips to Help You Improve the Health of Your Wealth so You Can Get Off the Treadmill of Working Till You Drop

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.

Private sector workers losers of SG increase

Most private sector workers don’t want a superannuation guarantee increase (SG Increase) as they will suffer a pay cut if they are pushed through. Read on to learn why.

First Home Super Saver Scheme (FHSSS) – How Does it Work and Why Use it

LinkedIn facebook Twitter First Home Super Saver Scheme (FHSSS)– How Does it Work and Why Use it The First Home Super Saver Scheme (FHSSS), is a scheme designed to help home buyers afford to buy first home by saving within their superfund instead of outside. How does...

Submission to the Banking Royal Commission

With all the talk about the banks and big finance companies at the Banking Royal Commission, I want to highlight that the issues go beyond them. Here is a copy of my submissions to Banking Royal Commission about what I believe is false and misleading marketing by Industry Super Australia.

Longevity Risk – One of the biggest risks you face in retirement

No one tells you that one of the biggest risks you face in retirement is Longevity Risk. Longevity Risk is the risk of your retirement money running out before you do. Read this to learn how longevity risk can impact on your lifestyle in retirement.

How Successful People Make Decisions Differently

Following on from my recent video on decision fatigue, I thought I would share an article about how successful people make decisions that I found interesting. Click here to read it

How Reference Points can make You Spend More

Did you know that businesses use a trick called reference points make you spend more? Read this to learn what they are so you can be aware of them and manage your spending better

The Rise in Homelessness in People over 55

According to the recent census data released by the Australian Bureau of Statistics, between 2006 and 2016, homelessness in people over 55 year grew by 49.5 per percent. This is nearly double the rate of growth in below 55 year olds (26.6 per cent).

Equal Pay Day April 10 2018

Today in the US is Equal Pay Day. Equal Pay Day is the approximate day all woman (irrespective of race) in the US, must work into the new year to make what the typical man made at the end of the previous calendar year. Want to beat the Gender Wealth Gap then learn more here

Winston Churchill Day – We are the masters of our fate

As April 9 is Winston Churchill Day, I thought I would share part of an actual speech by Winston Churchill which we all can draw on to focus our energies on finding the financial future we all want. It is about we are the masters of our fate.

Video of the Week Do Whatever It Takes – The Story Of The Young Man And The Guru

Welcome to my Video of the Week – Do Whatever It Takes – The Story Of The Young Man And The Guru

Here is a great video explaining about being successful. The key is you don’t count how many breaths you take, you just to do whatever it takes. When you want to succeed as bad as you want to breathe, then you will be successful.

How Taxes Work

Here is parable about 10 men in a bar that explains simply how taxes work and why it is often the higher income earners who get the biggest dollar savings from any tax cut, but not the biggest percentage cut.

Who has the better life in retirement, the Aussies or the Kiwis?

You may be surprised that according to the OECD 2017 Pensions at a Glance Report released late in 2017 that the Kiwis have a better life in retirement than the average Aussie. Watch this video to learn more.

Video of the Week Mike Cannon-Brookes and the Imposter Syndrome

Mike Cannon-Brookes, co-founder of software company Atlassian, is an Australian business success story. In this surprisingly personal talk, he reveals how even he suffers from the Imposter Syndrome. And more importantly he talks about how he’s learned to harness those feelings for his benefit.

It’s Smoke and Mirrors Day

March 29 is smoke and mirrors day. A day originally dedicated to magicians But is has now moved on to all areas of trickery, deceit and deception. So today, I thought I would share some of the trickery, deceit and deception I believe exists in the superannuation and financial services industries.

Video of the Week – Find Your Passion

Today I am sharing a video by Jay Shetty about why you need to find your passion. One of my favourite phrases from this video is “We force ourselves out of bed to live the same day again and again and call it a life”. I am trying to chase my passion. The question is are you?

Is Decision Fatigue Costing You Money?

Decision Fatigue could be costing you thousands of dollars. Watch this video to learn what decision fatigue is and how you can get this to work for you, not against you.

The EMC theory – How to get your next job

Next time you are starting to prepare the cover letter for your next job application, or getting ready for your next job interview, here is a different way to approach these which may work for you

How thinking like a professional footballer can get you paid more

With the footy season starting all over Australia, I thought I would share a video about how thinking like a professional footballer can get you paid more.

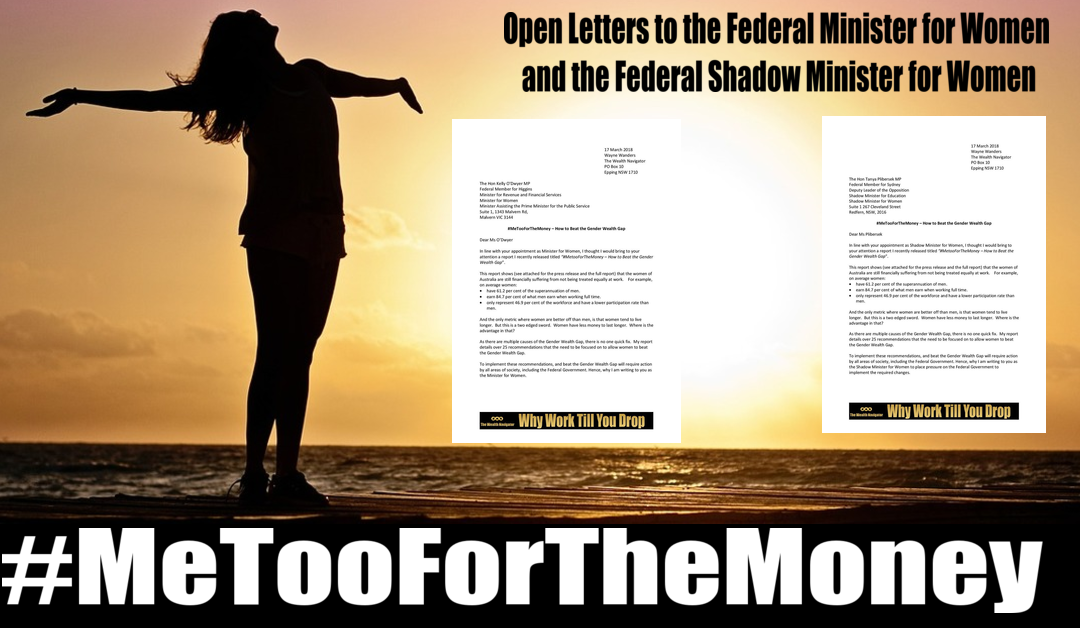

#MeTooForTheMoney – Open Letters to the Federal Minister and Shadow Minister for Women

My recent report “#MeTooForTheMoney – How to Beat the Gender Wealth Gap” had a large number of recommendations that require action by the Federal Government. So here are the letters I have sent to the Minster for Women and Shadow Minister for Women in Canberra to try and get financial equality for women sooner.

Insurance – How to save money by just by using the phone and internet

See how by jumping on the internet and by making a couple of phone calls you can save money on your insurance. In this real life example there was a difference of over $1200 from the dearest to cheapest – a big saving if you were on the most expensive.

Wayne Wanders, The Wealth Navigator Has Been Published in

FREE GIFTS

To help you on your journey to get off the treadmill of working till you drop, I have two FREE GIFTS for you. Firstly you can get the first 2 chapters of my book “Avoid the Poverty Trap” and secondly, you can watch a short video on why I believe most people are on the treadmill to work till they drop.

And you will join our Email Database for Content, Event Invites, Strategies and Ideas to help you IMPROVE THE HEALTH OF YOUR WEALTH and get you off the Treadmill of Working till You Drop!

Simply enter your name and email and click where it says CLICK HERE.

We promise to keep your email address safe.